Our 2025 Sustainable Investment Retrospective: Putting head in sand on ESG - a costly mistake

2025 felt like a whirlwind from a sustainable investment perspective. With no shortage of negative headlines, it is easy to be deceived in thinking it was a uniformly negative year. But scratch beneath the surface, and it becomes clear that the reality is far different. We highlight below the 5 biggest ways ESG issues impacted markets in 2025.

1. ESG created the best performing market?

If ever any evidence was needed to show ESG factors can positively impact security prices, look no further than the South Korean market in 2025. It is estimated that the Value-Up programme aimed at improving governance standards causally created 30% of the 74% rise in value this year1. Of course, we recognise that the AI driven semi-conductor giants Samsung Electronics and SK Hynix drove the remaining majority of the gains, but this represents a clear example of governance reform acting as a valuation catalyst and that our lobbying for many years on this front has begun to pay dividends.

This stands in sharp contrast to declining governance standards in the United States, where we observe unconventional policy making and weakening minority shareholder rights. In addition, the “K-shaped” economy and rising inequality is stretching the social contract. These underlying dynamics created a weaker institutional setting which created an amplifying context to the “sell America” trade driven by tariff announcements in April 2025.

2. Environmental concerns continue to shape technology and cash flows

Tightening global regulations on environmental matters leading to innovative challenger technologies continues to be an unavoidable theme for corporates. Returns from clean energy (45%) easily outstripped oil and gas (13%) in 2025, with further good news that the once rigid link between economic growth and carbon emissions is breaking across the vast majority of the world2.

This has been supported by European regulation such as the Carbon Border Adjustment Mechanism providing non-EU countries such as Taiwan, Turkey, India, Brazil and Japan with impetus to introduce their own national carbon markets so as to avoid new environmental import tariffs.

The two biggest environmental shocks during the year were the Spanish grid collapse and “forever chemicals” (PFAS) litigation. Even with Trump hollowing environmental policy support, rising PFAS litigation in the US got chemical companies hot under the collar. With $20bn paid out so far, the total end liability estimate from insurers is $160bn, highlighting the financial dangers of companies selling products that cause harm to human health3.

Furthermore, our investigate trip to Spain after the grid collapse on 28 April revealed that renewables were not to blame despite being optically at the start of the chain of disconnections. Many factors contributed to the chain of events and the root causes were the poor state of grid infrastructure, lack of adequate planning and the slow reactivity of utilities to help with regular grid balancing. This event highlighted the necessity of our grid infrastructure investment theme expressed through holdings such as Prysmian and Siemens.

3. Shifting role of defence in sustainability considerations

With NATO Secretary General Mark Rutte saying that “crazy” ESG rules were harming European defence, many asset managers were on the backfoot reviewing their policies. A quick Bloomberg analysis suggests that the largest defence companies have been able to pay €15bn in dividends, €10bn in share buy-backs, increased cash on their balance sheets by €12bn and paid down debt by €5bn. We observe that these are not the capital allocation decisions of capital constrained companies.

Instead, it is clear that the European defence industry has had a customer problem, with relatively stagnant spending between 2015-2023 and 63% of government defence spending going to US defence companies4. As asset managers re-considered the role of defence in sustainability, several high profile European asset managers scrambled to amend their overly restrictive defence policies, specifically where they were restricting conventional defence in SFDR Article 8 funds. Carmignac did not need to amend its policies during the year, reflecting a balanced approach to defence across our fund range.

4. Social issues debated extensively, but incentives dominated outcomes

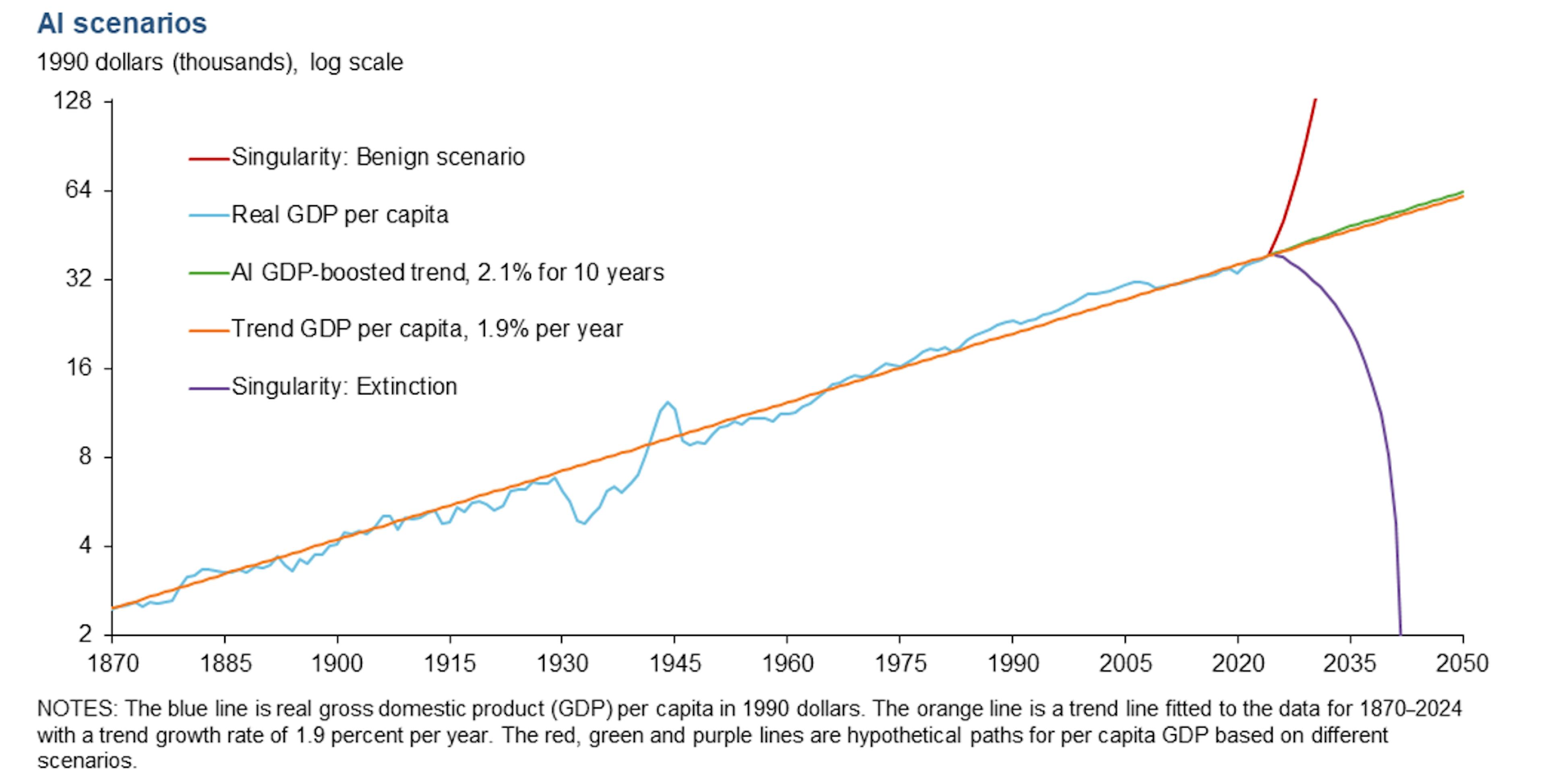

The two biggest social issues of the year were the consequences of AI and supply chain standards in the clothing industry. Leaving the energy considerations of AI to one side, the impacts of AI on unemployment, misinformation and critical thinking were heavily debated during the year. The chart below from the Federal Bank of Dallas appropriately demonstrates the broad range of predicted outcomes5.

Despite the depth of the debate, in practice, safety remains a topic of secondary importance in the geostrategic race for AI supremacy. We are focussing our corporate engagement efforts on AI governance, where we think a strong framework will help position companies for more durable success.

In the consumer goods sector, low labour standards in the clothing industry were a key topic. Loro Piana, Dior, Valentino, Giorgio Armani, Tods in the luxury sector and Inditex, H&M and Shein in the fast fashion sector all received press coverage for failings in supply chain standards. We are increasingly observing that companies which have vertically integrated supply chains that are centrally organised by head office have a lower likelihood of poor practices due to better visibility and control. Overall, our concerns on supply chain standards contributed to decisions that limited our exposure in fashion.

5. Pricing of negative externalities in security prices

It was an interesting year for traditional “sin stocks”. Tobacco significantly outperformed the MSCI ACWI by 15%, but alcohol underperformed reflecting shifting societal social patterns. The tobacco outperformance was driven by easing menthol cigarette regulation in the US, solid earnings from new non-combustible products, showering investors with dividends and crucially coming off relatively low valuations into the year. While of course other areas of the economy have offered even higher performance, it provided a useful example for investors that human health impacts on share prices are not straight forward.

Another area of environmental impacts being priced into securities is through the labelled bond market. While 2025 was largely a year where the labelled bond market had volume retrenchment and a consolidation of quality, it was also the first year many sustainability-linked bonds (SLB) observation dates / KPI checkpoints became due. Criticised for the targets being too easy at issuance, it was interesting to see many companies fail these targets. Companies like Europcar, Legrand and A2A Eni all missed their targets with coupons rising modestly between 12.5 to 25 basis points. We continue to believe that sustainable linked bonds are an important accountability mechanism, helping to align financial outcomes with sustainability performance.

1Morgan Stanley: Korea’s Value-Up 2.0: Only Half the Story.

210 Years Post-Paris: How emissions decoupling has progressed; Energy and Climate Intelligence Unit.

3PFAS Litigation Could Generate Billions in Ground-Up Losses.

4The future of European competitiveness by Mario Draghi (2024).

5Federal Bank of Dallas (2025); Advances in AI will boost productivity, living standards over time.

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com/en, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.com/en-gb, or upon request to the Management Company, or for the French Funds, at the offices of the acilities Agent, Carmignac UK Ltd, 2 Carlton House Terrace, London, SW1Y 5AF. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.com/en-ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.

For Carmignac Portfolio Long-Short European Equities: Carmignac Gestion Luxembourg SA in its capacity as the Management Company for Carmignac Portfolio, has delegated the investment management of this Sub-Fund to White Creek Capital LLP (Registered in England and Wales with number OCC447169) from 2nd May 2024. White Creek Capital LLP is authorised and regulated by the Financial Conduct Authority with FRN : 998349.

Carmignac Private Evergreen refers to the Private Evergreen sub-fund of the SICAV Carmignac S.A. SICAV – PART II UCI, registered with the Luxembourg RCS under number B285278.