While Donald Trump has plunged the world into a trade war, Germany has embarked on historic budgetary reforms that should improve the country's economic growth prospects. We believe this paradigm shift for the eurozone should prevent a return to the zero interest rates that prevailed during the past decade and thus offer an attractive prospect for investors.

With a current yield to maturity of 3.6%1, Carmignac Sécurité's flexible, low duration strategy provides some visibility in this uncertain environment and is well positioned to navigate this new context.

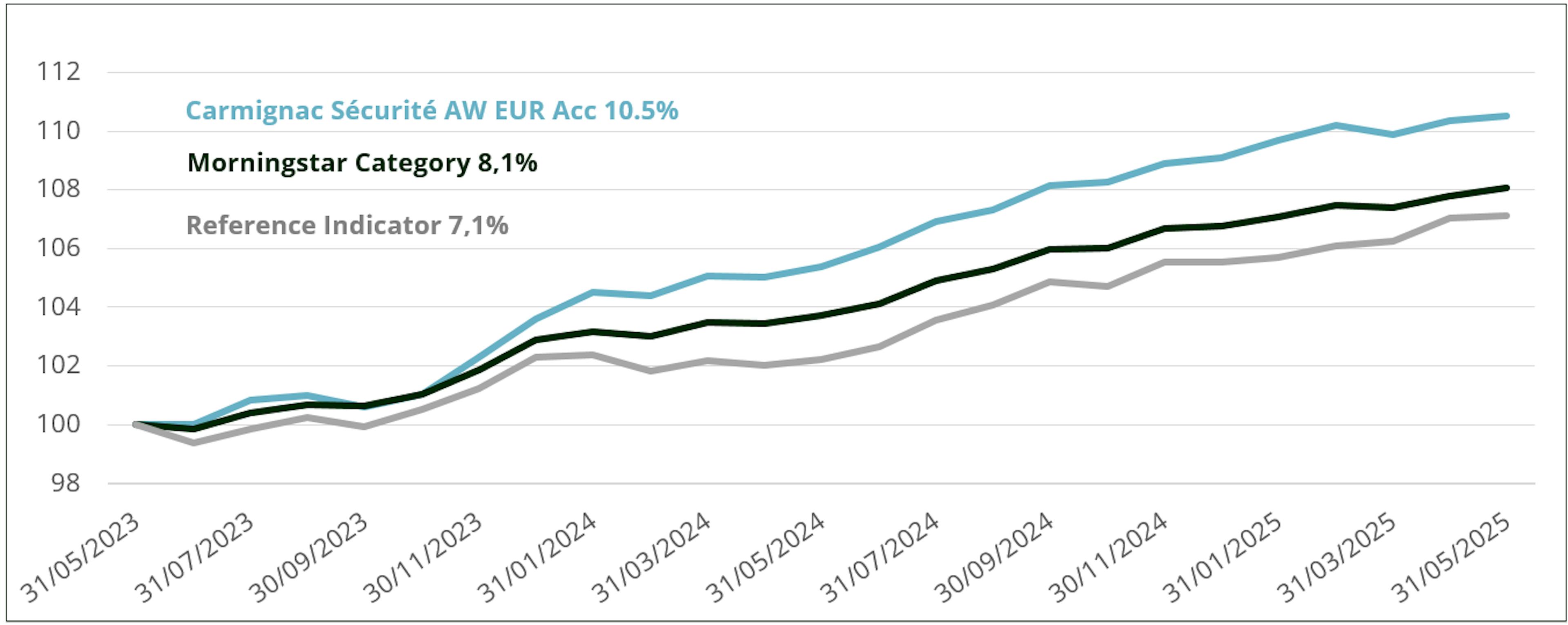

Strong performance achieved with low volatility

Carmignac Sécurité fully capitalized on the interest rate paradigm that emerged in 2022 due to the inflation shock, resulting in a repricing of rates from negative to consistently above 2%.

Based on the recommended two-year investment horizon, Sécurité has generated solid double-digit performance (10.5% for AW Acc shareclass as at 30/05/2025), which is all the more remarkable given that it was achieved with volatility of just 1.4%2 in an uncertain environment where the 10-year German bond yield fluctuated sharply between 2% and 3%, and credit spreads were well supported, albeit not without some turbulence.

Against this backdrop, all of the sources of performance for Carmignac Sécurité came into play. Carry3, supported by historically high interest rates, was clearly the main driver. However, active duration management (including curve steepeners and inflation products) and credit selection also contributed to the fund's performance, which was in the top decile of its Morningstar category.

Carmignac Sécurité 2-year performance versus reference indicator and Morningstar category

And if we focus on other periods, the picture is just as telling, confirming the relevance of this flexible, low-duration approach to European fixed income markets and its ability to adapt to different economic cycles and ever-unpredictable markets.

Fund's positioning in the EUR Diversified Bond - Short Term category

A reservoir of perfomance that is still intact

While the trade war that will undoubtedly affect economic activity, growth forecasts have been revised downwards across the board, Germany has embarked on a historic fiscal overhaul that should significantly boost the country's economic growth prospects. In fact, it could double Germany's potential growth over the next decade, and have a positive knock-on effect in countries closely linked to its industrial sector, such as France and Italy.

The combination of stronger economic growth and increased debt issuance to finance fiscal stimulus should drive interest rates higher, resulting in a steeper yield curve amid the European Central Bank's (ECB) accommodative policy stance. This would mark the end of the historic period of 'low forever' rates seen between 2012 and 2022, and usher in a new cycle of 'higher for longer' rates.

This new environment is particularly beneficial for Carmignac Sécurité, leveraging this high carry to provide a reliable performance source while also protecting against downside volatility, thereby achieving particularly attractive risk-adjusted returns. This is especially true given that the potential for capital gains linked to the tightening of credit spreads will be more limited from current levels.

At 3.6%, although this is slightly down from a year ago,** it remains well above its 10-year average**. This yield, which is mainly based on short-dated bonds, is a particularly reliable projection of future performance when yields are ‘high’, as is currently the case. This is therefore a good starting point, which can be optimised thanks to the Fund's multiple sources of performance, including active duration management and credit bond selection.

Carmignac Sécurité's yield versus sovereign bonds and credit over the last 10 years

Steeper curves = Great for Carmignac Sécurité but not for cash

Finally, the recent steepening of the yield curve under the effect of German fiscal stimulus measures and the ECB's monetary easing, has seen the spread between 2-year and 10-year rates reach almost 70 basis points, marking a return to mid-2022 levels. This development amplifies the shortfall of cash-like proxies compared to investment solutions like Carmignac Sécurité, which is flexible enough to sustain an attractive yield.

Carmignac Sécurité and 3-5 year € credit versus money market yields

How the Fund is navigating the current environment

In this particularly uncertain context, marked by trade wars, Europe's rearmament, debt issues, and ongoing global geopolitical conflicts, maintaining a balanced portfolio is essential. We believe that the barbell positioning, which proved effective over the past two years, remains relevant today. This strategy balances credit exposure with active management of duration and money market instruments, enabling Carmignac Sécurité to benefit from its carry in a gradual monetary normalisation environment, as well as to withstand temporary market turbulence, as demonstrated recently with the tariff announcement on 'Liberation Day,' resulting in limited drawdown and volatility.

- A significant allocation to credit (c. 73.5%), mainly invested in short-dated, highly rated corporate bonds offering an attractive source of carry and a reduced beta to market volatility.

Balanced with:

- Curve steepeners in Europe, with increased supply of government bonds against the backdrop of the German stimulus package, defence spending and the trade war, as well as optional strategies on German and US curves.

- Credit protection, with 6.0% of iTraxx Xover via credit default swaps on the back of the trade war, geopolitics, growth concerns and tight spreads.

- 23% is invested in money market instruments, providing an attractive source of carry with limited risk.

- And finally, a Yield-to-Maturity of 3.6%, which is a source of regular performance and also the first line of defence during periods of interest rate and/or credit spread correction.

Carmignac Sécurité

Carmignac Sécurité AW EUR Acc

- Recommended minimum investment horizon

- 2 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 1.00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1.11% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- There is no performance fee for this product.

- Transaction Cost

- 0.14% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Sécurité | 2.1 | 0.0 | -3.0 | 3.6 | 2.0 | 0.2 | -4.8 | 4.1 | 5.3 | 1.3 |

| Reference Indicator | 0.3 | -0.4 | -0.3 | 0.1 | -0.2 | -0.7 | -4.8 | 3.4 | 3.2 | 1.5 |

| Carmignac Sécurité | + 3.7 % | + 2.0 % | + 1.0 % |

| Reference Indicator | + 1.7 % | + 0.5 % | + 0.2 % |

Source: Carmignac at May 30, 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: ICE BofA 1-3 Year All Euro Government index

MARKETING COMMUNICATION. Please refer to the KID/prospectus of the Fund before making any final investment decisions. This document is intended for professional clients. This document may not be reproduced, in whole or in part, without prior authorisation from the management company. It does not constitute a subscription offer, nor does it constitute investment advice. The information contained in this document may be partial information and may be modified without prior notice. The decision to invest in the promoted fund should take into account all its characteristics or objectives as described in its prospectus. The reference to a ranking or prize, is no guarantee of the future results of the UCITS or the manager. Carmignac Sécurité is a common fund in contractual form (FCP) conforming to the UCITS Directive under French law. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. Access to the Fund may be subject to restrictions with regard to certain persons or countries. The Fund is not registered in North America, South America, Asia or Japan. The Funds are registered in Singapore as a restricted foreign scheme (for professional clients only). The Fund has not been registered under the US Securities Act of 1933. The Fund may not be offered or sold, directly or indirectly, for the benefit or on behalf of a “U.S. person”, according to the definition of the US Regulation S and/or FATCA. The Fund presents a risk of loss of capital. The risks and fees are described in the KID (Key Information Document). The Fund’s prospectus, KID and annual reports are available at www.carmignac.com, or upon request to the Management Company. The KID must be made available to the subscriber prior to subscription.

In Switzerland, the Fund’s prospectus, KID and annual reports are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. The KID must be made available to the subscriber prior to subscription. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in French, English, German, Dutch, Spanish, Italian at the following link “Summary of investor rights”): https://www.carmignac.com/en_US/regulatory-information.

CARMIGNAC GESTION – 24, place Vendôme - 75001 Paris. Investment management company approved by the AMF. Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

CARMIGNAC GESTION LUXEMBOURG – City Link - 7, rue de la Chapelle - L-1325 Luxembourg. Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF. Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 549.