Is the honeymoon already over for money markets?

Carmignac’s Note

“Interest rates are at the heart of any financial transaction or calculation.”

This business cycle has been unusual in many respects, as reflected in movements in financial markets. After a steep sell-off in 2022, markets staged a strong comeback in 2023 against a backdrop of unprecedented monetary tightening. Yet investors and savers, true to form, were driven just as much by greed than fear.

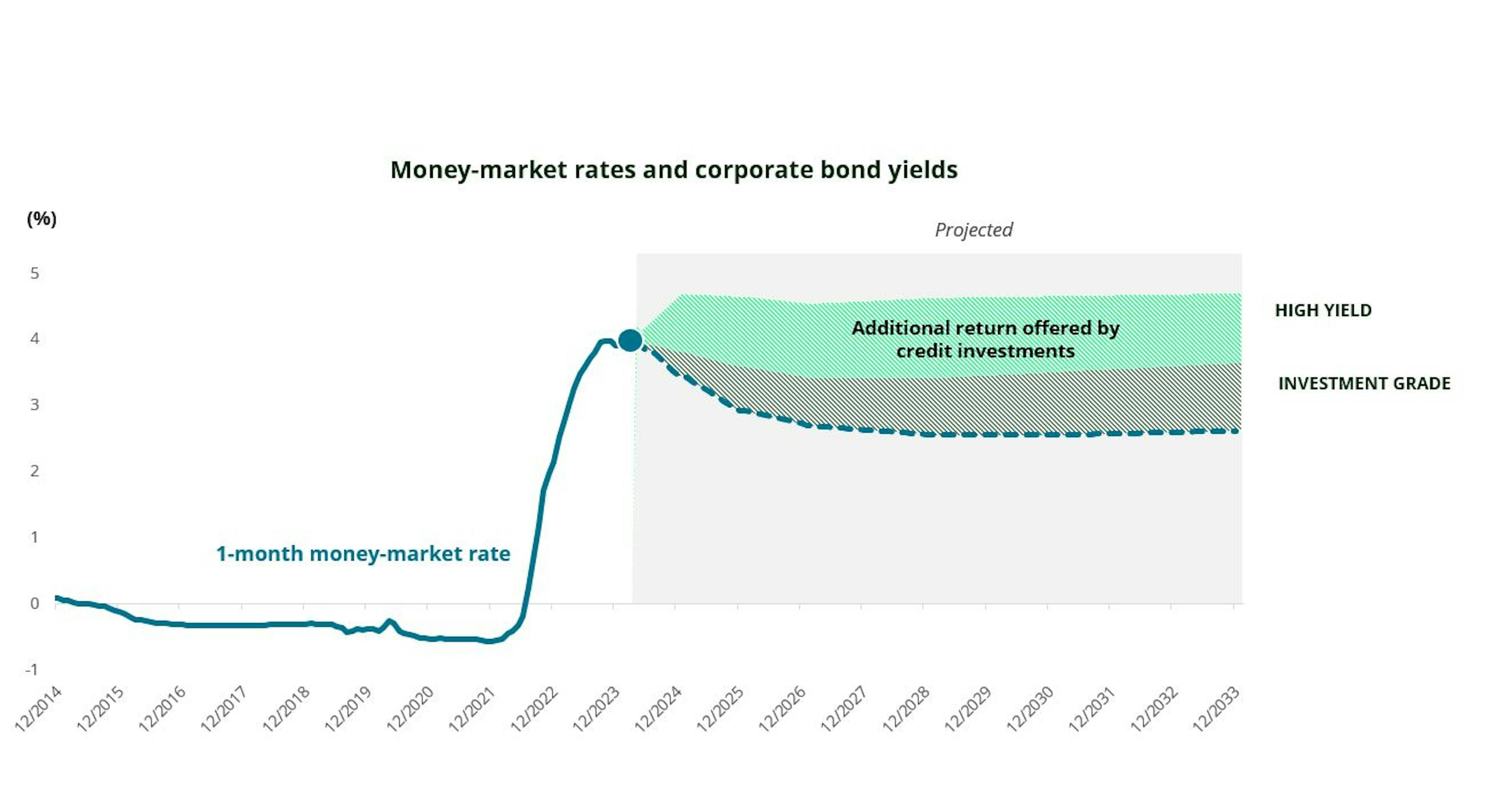

They hitched onto the rally in money-market interest rates (blue line on the graph)1, motivated by the prospect of handsome returns2 (nominal interest rates currently sit at nearly 4% - blue point on the graph) and by concerns of seeing a repeat of 2022 when equity and bond prices fell in tandem.

This was good news for sovereign issuers. Government bonds targeted to retail investors proved highly successful in Europe3, and the US Treasury was able to finance its deficit through short-dated paper. It was a boon for investors, too, as money markets delivered attractive returns in 2022 and the first half of 2023. But we shouldn’t overlook the consequences of central bankers’ recent pivot. A growing number of these government bonds will soon reach maturity, and with the likely cuts to key policy rates, the return on money-market instruments will also fall (dotted blue line on the graph).

Today, anyone who invests in a money-market fund or short-term deposits with an attractive nominal interest rate should realise that the rate will most likely be lower when comes the time to roll over such investment. Money-market returns are set to be lower, unless inflation bounces back and central banks start hiking again as a result. That means money-market investors will be exposed to reinvestment risk, or the risk that their assets or savings will be reinvested at a lower interest rate – resulting in lower returns down the line.

What can investors do?

First, they need to act now to secure attractive returns in the future. One direction to look is towards credit markets. Corporate bonds offer significant spreads that investors can capture for the coming quarters or even years. The shaded green and grey areas on the graph indicate the additional returns that high-yield and investment-grade bonds now offer over money-market instruments. Or put another way, these areas indicate the “opportunity cost” to investors if they leave their savings in the money market or are slow to change their asset allocation. This opportunity cost sits at 1% to 2% per year – hardly a negligible sum.

The appeal of strategies offering more elevated returns will probably underpin the prices of carry assets going forward, and reinforce the benefits of active investment over money-market funds. Here, it’ll be key to have a good grasp of investor behaviour – influenced heavily by central-bank decisions – if only for the highly speculative nature of such behaviour. To paraphrase Schumpeter: Interest rates are at the heart of any financial transaction or calculation.

EXAMPLE

Suppose an investor has €50,000 to invest over a 2-year horizon.

If he/she decides to invest in money markets, they basically have two options:

Block the money in a 2-year fixed-term deposit at 3% – well below the ECB’s current interest rate of 4%, since the market has already priced in future ECB rate cuts – resulting in a capital gain of €3,000; or

Invest in shorter-dated paper, reinvesting the proceeds continuously over the entire 2-year period. The investor will earn 4% interest for the first 3 months, but then, as the ECB cuts rates, this will drop to 2% or 2.5% within a few quarters, resulting in a total capital gain of €3,500 (based on current policy rate expectations).

If, on the other hand, the investor decides to place the money in credit markets, they’ll book a €3,800 capital gain if he/she chooses investment grade bonds, or a €4,700 capital gain if he/she chooses high-yield bonds – all based on current expectations.

Active fund managers have a wide range of tools they can use to boost the returns on their bond portfolios. While this mainly entails operating in the credit market, but they can take advantage of other performance drivers too, such as inflation and duration. A look at funds performance since S2 2023 shows that actively managed funds have significantly outstripped their money-market counterparts. Of course, active funds come with higher interest-rate and credit risk, but in today’s environment of a resilient economy, ongoing disinflation, and central bank rate cuts, their returns could diverge substantially from money-market ones – giving rise to a genuine opportunity cost for money-market investors.

1Some $1.5 trillion has poured into US money-market funds since the Fed started hiking interest rates. The corresponding figure in Europe since the ECB embarked on its tightening cycle is upwards of €350 billion.

2The interest rates on these money-market instruments and sovereign bonds for retail investors were the highest they’d been since the 2008 financial crisis.

3To give just two examples, France’s Livret A drew a record €30 billion and Italy’s BTP Valore a record €35 billion.

![[Management Team] [Author] Thozet Kevin](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Thozet-Kevi.png?auto=format%2Ccompress&fit=fill&w=3840)