In an environment characterised by zero or even negative interest rates, does it still make sense to invest in fixed income markets?

Discover the response from our Fixed Income Management Team’s and learn more about their Unconstrained approach designed to navigate through complex market environments.

A common philosophy for 4 complementary solutions

Our Unconstrained Fund range is composed of complementary funds sharing the same investment philosophy and designed to meet various investor profiles.

![[Insights] 2020 03_FN_Unconstrained (All) EN](https://carmignac.imgix.net/uploads/article/0001/11/4c66a1619560d7cd3d678932a2eddc7a6f97a008.png?auto=format%2Ccompress&fit=fill&w=3840)

Potential Returns are forecasts. Performance forecasts are not a reliable indicator of future performance.

On March 10th, 2021, four of our Fixed Income Funds have changed their name. The word “unconstrained” has been removed and Carmignac Portfolio Unconstrained Euro Fixed Income has been renamed Carmignac Portfolio Flexible Bond.

To learn more about our Unconstrained approach:

Carmignac Sécurité AW EUR Ydis

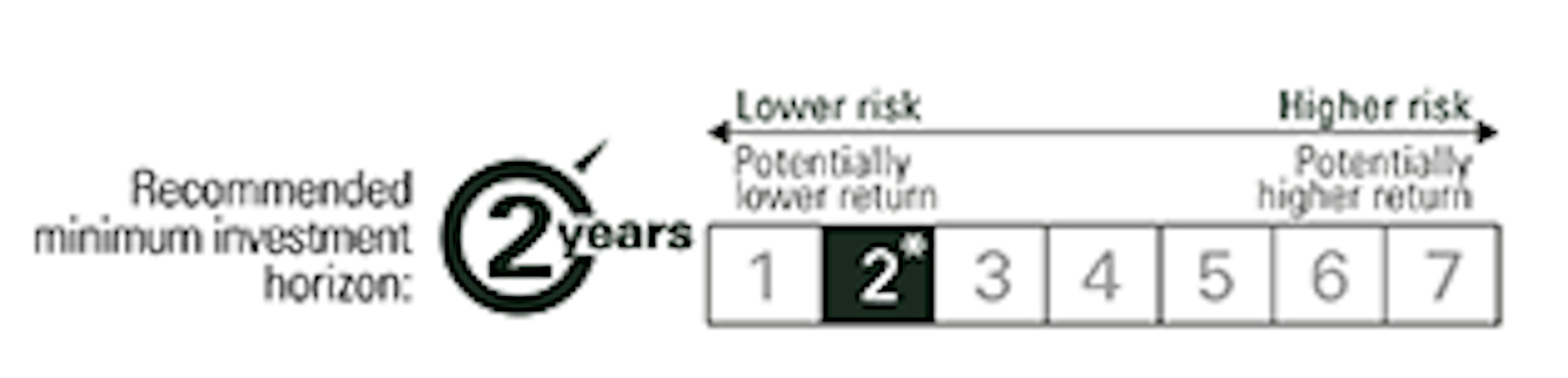

- Recommended minimum investment horizon

- 2 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. The SFDR classification of the Funds may change over time.

Main risks of the fund

Carmignac Portfolio Credit A USD Acc Hdg

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 6

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. The SFDR classification of the Funds may change over time.

Main risks of the fund

Carmignac Portfolio Global Bond E USD Minc Hdg

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. The SFDR classification of the Funds may change over time.

Main risks of the fund

The Funds present a risk of loss of capital.

*A EUR Acc share class. Source: Carmignac at 06/02/2020. Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. Carmignac Portfolio Unconstrained Euro Fixed Income is the new name for Carmignac Portfolio Capital Plus, introduced after changes to the Fund prospectus that went into effect on 30 September 2019.

Unconstrained approach: this is an active approach that is unconstrained by any reference indicator, thereby allowing greater flexibility in terms of exposure management and enabling the Funds to face extremely varied market environments.

Promotional material. Video recorded on 23/01/2020. This video may not be reproduced, in whole or in part, without prior authorisation from the management company. This is an advertising material. This video does not constitute a subscription offer, nor does it constitute investment advice. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). Carmigac Sécurité is a common fund in contractual form (FCP) conforming to the UCITS Directive under French law. Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. Access to the Funds may be subject to restrictions with regard to certain persons or countries. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a U.S. person, according to the definition of the US Regulation S and/or FATCA.The Funds present a risk of loss of capital. The risk, fees and ongoing charges are described in the KIIDs (Key Investor Information Document). The Funds' respective prospectuses, KIIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management Company. The KIIDs must be made available to the subscriber prior to subscription. • In the United Kingdom, the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This material was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement • In Switzerland, the Fund’s respective prospectuses, KIIDs and annual reports are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. The KIID must be made available to the subscriber prior to subscription.

![[Main Media] [Video] 2020 03_FN_Unconstrained (All)](https://carmignac.imgix.net/uploads/NextImage/0001/11/d0d83afe4f7fde1b68fcea019420091ffefb3c44.jpeg?auto=format%2Ccompress&crop=faces&fit=crop&w=3840)