A few months after SFDR1 entered into force, it will soon be time to come into effect for a new responsible investment technical jargon: the EU Taxonomy.

While - fortunately - both regulations aim to go along together, this rules-based classification system with scientific technical standards to respect for mostly all environmental activities deserves to be explained as it is likely to contribute to reorienting investments towards climate protection.

A: Ambitions of a greener future

The European Commission is committed to sustainable development and environmental protection through regulation. In recent years, overarching global initiatives such as the EU Green deal and the Paris Agreement have been great foundations to the European Union’s climate neutrality goal by 2050. The participation of both the public and private sector, in particular the financial services sector, is necessary to achieve such an ambitious objective.

Defining a classification of green activities to identify and respond to investment opportunities and contribute to achieving the European Union’s climate-related objectives, is one instrument of the EU Green Deal (SFDR is another one). The EU Taxonomy will affect companies well beyond European borders.

B: Back to Basics

So what is the EU Taxonomy really?

The Taxonomy is a list of economic activities with performance criteria to assess the activities’ contribution towards six environmental objectives:

Climate Change Mitigation

Transition to a circular economy

Climate Change Adaption

Pollution prevention

Sustainable use of water and protection of marine resources

Protection and restoration of biodiversity and ecosystems

In other words, it describes which activities can be considered "green" and which can’t.

What is it NOT?

The Taxonomy establishes a list of environmentally sustainable activities, but it is neither a rating of "good" or "bad" companies nor a mandatory list of economic activities to invest in or to divest from. It should ultimately however increase investment in activities deemed environmentally sustainable across a range of sectors, including forestry, green buildings, information and communication Technology, manufacturing, transport, utilities and finance. Importantly, it is also a tool designed to evolve. For example, in the future it could include activities such as nuclear and gas and cover social objectives (so-called Social Taxonomy).

The following figure summarizes what the Taxonomy is and isn’t:

Is

A list of economic activities and relevant criteria

Flexible to adapt to different investment styles and strategies

Based on latest scientific and industry experience

Dynamic, responding to changes in technology, science, new activities and data

Is not

A rating of good or bad companies

A mandatory list to invest in

Making a judgement on the financial performance of an investment – only the environmental performance

Inflexible or static

Source: Technical Expert Group June 2019 draft usability guide

Why has it been developed?

The objective of this science-based body of work is to bring clarity on what should be considered green and help re-allocate capital towards economic activities and companies contributing to environmental objectives. European legislators are using it to:

• Create common definitions for sustainable activities and investment practices

• Prevent false claims on the environmental nature of an investment product

• Provide clarity on what it takes, within specific industries, to achieve the commitments made under the Paris Agreement

• Put environmental data in context, creating a holistic set of expectations to claim Taxonomy alignment - based on 3 key performance indicators: turnover, capital expenditure2 (CapEx) or operating expenditure (OPEX)3

• Reward companies who follow the direction set by this science- and evidence-based framework

When was it developed?

In July 2018, the European Commission set up a Technical Expert Group to assist it in developing an EU classification system – the so-called Green Taxonomy – to determine whether an economic activity is environmentally sustainable. More recently, on the 22nd of October 2021, the European Supervisory Authorities delivered to the European Commission their Final Report with the draft Regulatory Technical Standards (RTS) regarding disclosures under the Sustainable Finance Disclosure Regulation (SFDR) on the establishment of a framework to facilitate sustainable investment based on Taxonomy Regulation (EU) 2020/852.

Please see below a more detailed timeline showing that the EU Taxonomy is at the center of the EU’s Green deal:

How will asset managers report Taxonomy alignment in theory?

There are several steps to calculate the Taxonomy alignment of a company according to principles laid out in the EU Taxonomy4.

Step 1: Are these companies involved in any of the Taxonomy-eligible economic activities?

- Map the company’s eligibility by using Bloomberg BICS codes or another sector-based data source against the NACE* codes within the Taxonomy tool

Step 2: Verification of NACE activities and substantial contribution.

- Obtain the % turnover/CAPEX / OPEX to gauge to what extent the company could be aligned. Establish if the company’s products and services meet the technical thresholds established in the Taxonomy “substantial contribution” guidelines as defined inside the Taxonomy technical report5 and revise the calculation for only eligible revenues

Step 3: Is there any harm to other Taxonomy-eligible activities (DNSH6 )?

- Perform proprietary analysis using company data to investigate adverse impacts such as waste management, pollution, effects on biodiversity, contributions to circular economy so that there are no significant negative impacts on the other 5 Taxonomy objectives

Step 4: Determine if the company employs minimum safeguards

- Does the company violate international business norms, including OECD Guidelines for Multinational Enterprises?

By incorporating both the quantitative and qualitative approach the asset manager can determine the alignment at a company level and through weighted average at the portfolio level.

Taxonomy alignment in practice

While the availability of revenue data is relatively detailed per business activity, CAPEX and OPEX data is often not rendered public for specific activities. Secondly, the ability to verify the “substantial contribution” thresholds is hindered by the lack of current requirements to render information public, ahead of the future company disclosure legislation impacting companies from only 2023, for reporting in 2024.

C: Carmignac’s view on the EU Taxonomy

Why does it matter?

As financial market participants, this initiative is important because, until now, there was no common classification system at global or European level that defines the requirements or criteria to be satisfied by an economic activity in order to be considered “green”. It matters even more because it is meant to be the bedrock of many financial mechanisms at the European level (EU Green Bond Standard, Eco-Label for financial products, etc). We think that, as more than 50% of European funds could be qualified as Article 8 or Article 9 by mid-2022 (according to Morningstar), this is likely to foster the transformation of ESG Investing practices, with a shift towards activity-based metrics.

As long-term active investors, we integrate environmental risks in our investment process and engage with companies on how their activities align to the EU Taxonomy, if they have not already done so.

Companies can then consider appropriate actions to reduce potential regulatory and financial risk from activities that may be causing harm to another environmental goal (cf DNSH: Do No Significant Harm criteria) as well being more proactive in their intension to adjust policies and practices to pass the strict technical criteria and align their revenues and operations to taxonomy activity-led goals. In this regard, investors’ decisions to allocate capital or influence companies through engagement can contribute to reorienting investments towards climate protection and the SDGs.

Our Fund Carmignac Portfolio Climate Transition puts this into practice. It seeks to invest at least 60% of assets in companies whose business activities contribute to climate change mitigation and positive environmental change. The investment universe to measure the sustainable objective has been composed using proprietary analysis to identify companies with revenues from economic activities that qualify as environmentally sustainable according to EU Taxonomy standards.

What comes next?

We will have an obligation to disclose how our funds align to the EU Taxonomy, i.e the alignment of funds that have E and S characteristics and those that have sustainable investments and goals for climate mitigation and climate adaptation from January 2022, covering the reporting period of 2021.

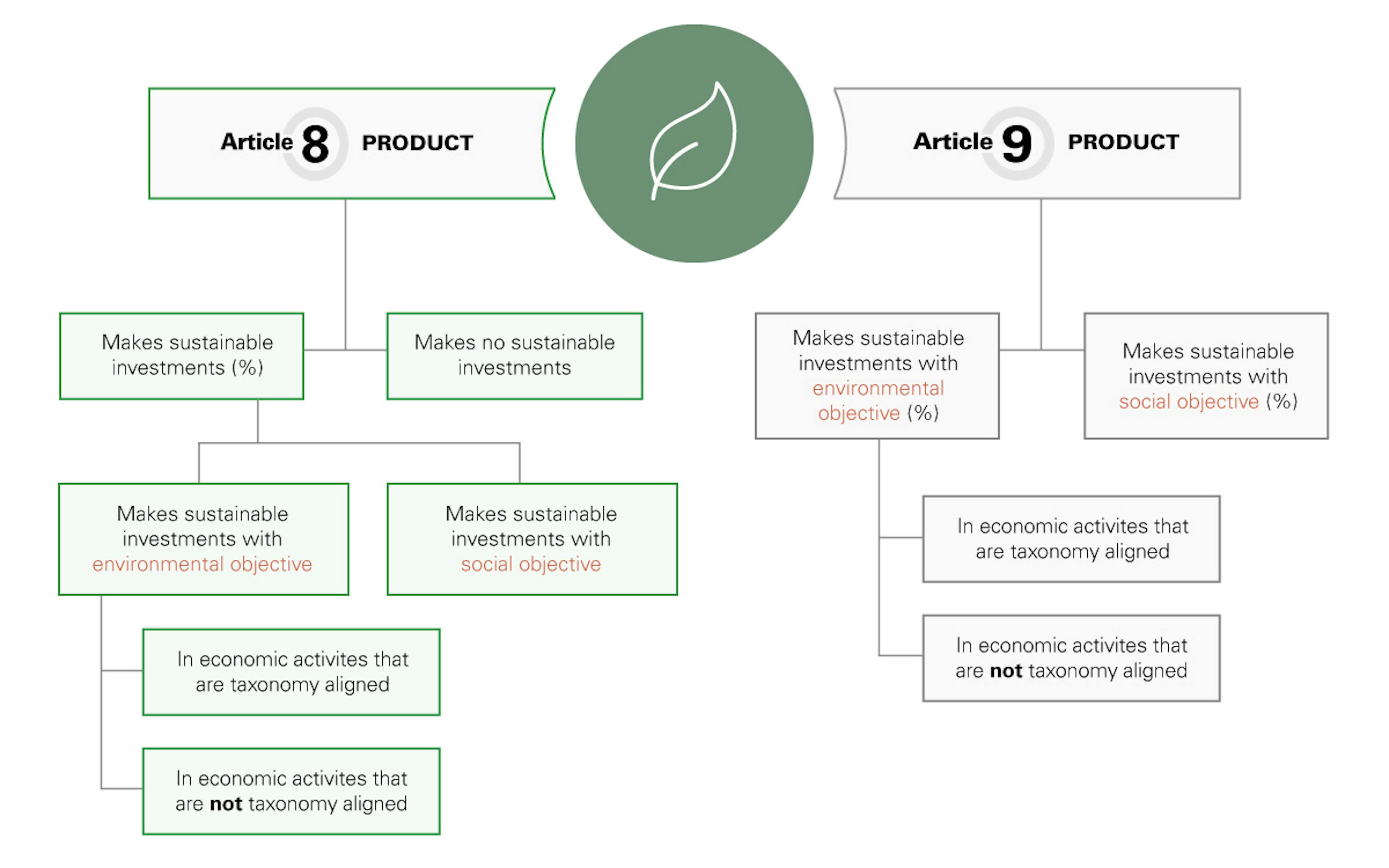

With the latest publication of the final RTS at the end of October, many points that had kept the asset management industry wondering for most of 2021 have been now clarified. The funds that fall within the scope of SFDR Article 8 and Article 9 - which classify investment products according to their degree of sustainability - will be divided according to their Taxonomy alignment:

As we are now entering a period in which only a handful of companies report their taxonomy alignment, third party estimates will coexist with company estimates, investors should proceed with caution until before the final reporting is available.

To conclude, Taxonomy means more work for companies and financial market participants, but is great news for end investors, as it means more harmonised information readily available to them.

Articles that may interest you

The fashion industry's crossroads: Can sustainable apparel deliver scalable returns?

Quarter 2 2025: Our active stewardship illustrated