Europe: From Doghouse to Powerhouse

European assets are experiencing a remarkable rally, reflecting the seismic shifts in the very foundations of the developed world order. While the US increasingly adopts an isolationist policy, Europe is undergoing profound change, and fast changing dynamics on the Old Continent suggest a new era of economic expansion is upon us, marked by strategic reorientation, and the opportunities it presents are significant, explains Kevin Thozet, Portfolio Advisor and Member of the Investment Committee at Carmignac.

From stagnation to recovery

After two years of stagnating economic growth, Europe appears to be finally emerging as an economic powerhouse, with Germany having taken many by surprise with the size and the speed at which its fiscal U-turn unfolded.

The German infrastructure spending plan of 1% of GDP per annum, along with potentially unlimited defence spending – which we expect to be at 0.6% to 1.0% of GDP for the next two calendar years – has nothing to envy the Marshall Plan, the Reunification or the response to the Great Depression. It is no typical emergency fiscal spending plan; this one will last for many years and, given the high multiplier effect of infrastructure investment, it is expected to materially lift the country’s economic growth prospects. Indeed, it could well double the potential GDP growth of Germany over the coming decade, while the benefits should also be felt by those economies with close manufacturing ties to Germany, such as France and Italy.

In addition to such fiscal expansiveness – and in the same long-term growth-boosting vein – European authorities are also tackling internal barriers. Scaling up the single market and removing intra-EU barriers could boost productivity and generate up to 0.7% GDP per annum over a 10-year period, we believe.

Not all plain sailing just yet...

Sequencing matters in Europe too. German debt issuance is expected to grow by 1.5 times over the next five years, a potential positive for the global status of the euro. But it’s also a cause for concern as higher economic growth and more debt issuance tend to come hand in hand with higher interest rates. The effects of the latter are already reflected by higher bond yields yet the impact of higher economic growth is unlikely to be felt until 2026. What’s more, the pain of increased tariffs will be felt before the benefits from the fiscal package are realised; there is still discomfort to come.

Another key question is whether German households will behave according to the Ricardian Equivalence Theorem: will households adjust consumption/savings in anticipation of future taxes and therefore offset the impact of government spending? It is a possibility, but it an unlikely one as authorities are rather hinting at the lowering of taxes and given the households’ savings rate is already at a multi-decade high of 19%.

Playing catch-up

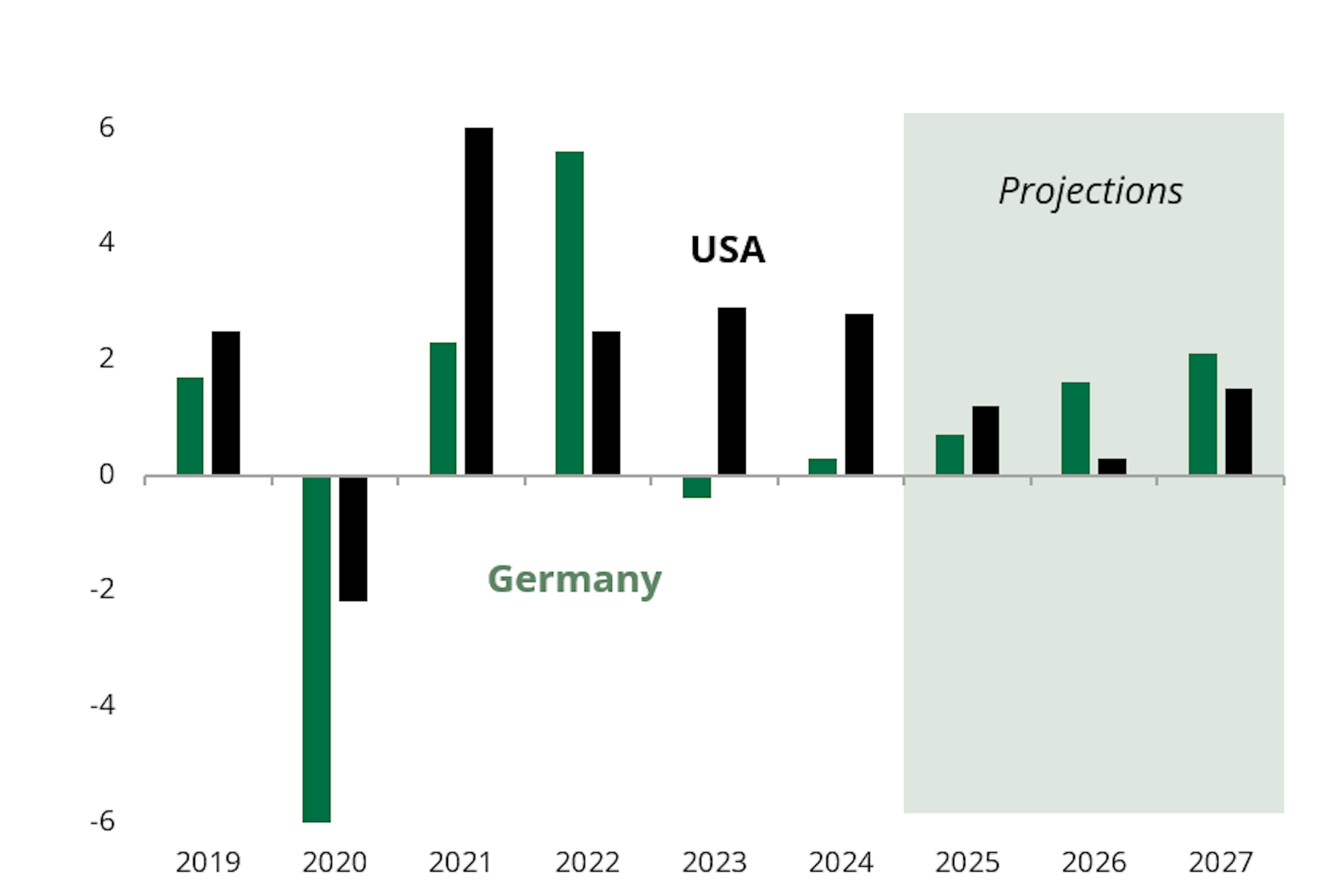

European economic growth is expected to stand at 0.8% in 2025, with consumption spending continuing to improve along real income gains; and lower European Central Bank policy rates supporting credit demand and pushing down the savings rate. The potential improvements in sentiment could also start to be felt in company capex. And further out, we expect to see the baton handed from consumer spending to public and private investment – come 2026, fiscal support and capex running at full speed should allow GDP growth to run above potential at 1.4%, we believe.

That is, of course, in sharp contrast to the US. Across the Atlantic, the policy framework is increasingly being questioned by erratic trade policy, the overlooking of fiscal guardrails and threats to both the US Federal Reserve’s independence and the rule of law. All of which echo the Triffin Paradox; as identified 60 years ago by Robert Triffin, persistent deficits, fiscal expansion, and shifting investor confidence create ongoing risks for inflation, interest rates, and the US dollar’s reserve status. And that’s before we consider the potential for a stagflation shock induced by tariffs morphing into recessionary pressures.

And so, a scenario where the economic growth rate, in both nominal and real terms, of Germany is on par with, or even above that of the US within the coming two years is a very real prospect, we believe.

EVOLUTION OF GDP, YEAR ON YEAR, IN %

A golden bullet for European equities

Monetary easing and fiscal easing evolving in tandem is a rare narrative. And a very powerful one. Markets have rapidly adjusted to such game-changing prospects, with European equities erasing one year of underperformance versus the US within just three months. Even more striking has been German equities, which have closed five years of underperformance within five months.

These developments have been swift and material but caution is wise given they are occurring at a time of richly valued global markets, and rapid and major top-down shifts on both sides of the Atlantic.

The fiscal impulse is huge. The rule of thumb is that 1% of GDP growth translates into 0.8% of additional EPS growth; such an impetus would push EPS growth in some European countries – and notably Germany close to 10% next year and 15% in 2027, outstripping what is expected of the mighty S&P 500.

All importantly, such fiscal impetus will be lasting for decade, feeding into company earnings for many years. At the sector level, industrials is most directly affected by infrastructure and defence spending, and technology from modernisation and digitalisation. Meanwhile, the financial sector stands to benefit from a more favourable economic growth environment, but it would also benefit greatly from more cross-border banking integration. Watershed moments like this tend to provide significant support for valuations, too. The two “whatever it takes” moments in the past 15 years saw European equities P/E ratios go up by 3x in absolute terms and 1x relative to the US. With European equity indices priced at 14x 2025 earnings and 13x in 2026, the starting point in valuations is good.

VALUATION MULTIPLES (PRICE / FORWARD EARNINGS) OF MAIN EQUITY INDICES

Solid foundations

The current equity market structure also provides a very positive backdrop for the construction of diversified portfolios, in our view. Quality and growth stocks have massively derated, with the likes of Novo Nordisk, ASML, Hermes and Schneider Electric down by 20% to 60% in price terms and by more than that in valuation terms over the last 6 months, yet the long-term growth prospects for their earnings remain in the mid to high teens. Moments when high-quality companies can be bought at discounted prices are relatively rare; now is one of those opportunities to acquire (more) shares of strong businesses with sustainable competitive advantages and consistent earnings trajectories at a huge discount. Meanwhile, an increasing number of banks in the region have conducted and expanded buyback programmes, paying dividend yields of between 6% and 7%.

Europe stands to be one of the main beneficiaries of the faltering US market. European markets are the deepest and most liquid outside of the US, yet the combined European stock market capitalisation remains three times smaller than that of the total US market. An increase in global financial flows to Europe should therefore have a higher marginal effect on performance.

The combination of lower energy prices, long-lasting fiscal stimulus, monetary easing and an attractive valuation starting point bodes well for European equity markets over the next three to five years. And even over the short-term, in which the US market could well fall further, we would expect European equities to outperform on the downside.

Staying in credit

The aforementioned growth backdrop is positive for risk assets and companies alike. And, broadly speaking, what is true of equities is also true for credit markets.

So far in 2025, bond yields on both sides of the Atlantic have risen by a similar amount – the yield to maturity of both US and European high yield indices are up by more than 60 basis points – however, the contributors behind these higher yields differ.

The increase in US bond yields reflects growing concern over the resilience of the economy and rising delinquencies; in Europe, it reflects enhanced growth prospects and a more balanced contribution of rising credit risk (spread) and interest rates risk (term premium). In short, while corporate bonds yields are rising in both in the US and Europe, they are rising for good reasons in Europe but for bad reasons in the US.

The financing of both short-term relief plans to address the impact of tariffs and of the longer-term Zeitenwende 2.0 will require more debt issuance. As a result, we believe longer-dated bond yields should trend higher, with fair value closer to 3% on the German 10-year Bund within the next six months, reflecting better growth prospects and wider deficits.

‘Safe-haven’ status

There are other positive developments on the sovereign debt front, too. The development of the euro as a ‘global’ currency requires the issuances of large quantities of liquid and secure assets, equivalent to US Treasuries, and the scarcity of core bonds has somewhat slowed the euro’s internationalisation. The prospects of more bonds issued by Germany – an AAA-rated country – and the increased likelihood of more common financing in Europe bode well for the euro.

In fact, the stability in euro bond markets in the past weeks, in stark contrast with their US peers, along with the euro being utilised as a ‘safe haven’ in a severe risk-off environment, are telling signs of these notable developments.

Finally, inflation break-evens in Europe are also expected to rise as Germany’s long-term investment in infrastructure piques producer and consumer prices, coupled with US tariff-shielding fiscal supports. Furthermore, Europe’s reliance on commodity imports also means the region remains vulnerable to future spikes in commodity prices.

IMPLICATION FOR OUR EUROPEAN EQUITY FUND

FP Carmignac European Leaders: a rising tide lifts all boats.

In 1950’s-1960’s Germany experienced rapid economic growth, the “Wirtschaftswunder” (economic miracle) and over that period German equities delivered two to three times the returns of US equities. But what is happening in Europe goes beyond fiscal support of historical magnitude and defence stocks; the roll-out of the “competitivity compass”, the development of a “saving & investment union” and the reform of telecommunication regulations to support a thriving digital economy are all moving in the right direction. In such a context, the inclusion of European equities in an equity portfolio would materially improve the expected returns.

For the past decade or so, the general perception was that only US equities could deliver strong risk adjusted returns. But, over this same period the largest European companies have delivered returns similar to their US counterpart. And this has been achieved with much greater diversification – in terms of countries and sectors. Over that period the returns of Hermes, Ferrari or ASML are on par with that of Meta, Alphabet or Apple. Rheinmetall or Argenx have delivered returns above that of Tesla. All (except for the German arm manufacturer) constitute some of our funds’ core convictions. And in fact well managed European equities strategies – such as the one run by Mark Denham – have delivered returns on par with that of US equities, neutralizing the FX risk.

The current environment provides for a great backdrop for European equities, and for a fund like FP Carmignac European Leaders. Firstly, the market reset since early February has created a window of opportunity to strengthen and initiate positions in companies that have massively derated and are trading at attractive valuation points for long term investors. Exposure to long term internationally exposed quality companies like Novo Nordisk, ASML and L’Oreal that currently trade at 10 year lows on a P/E basis have been strengthened. Secondly, we built positions in companies and sectors which show attractive valuations and will benefit from the macro environment mentioned earlier. Indeed we increased our weight to Industrial and Material stocks from 10% early January to more than 25% as of end of April. This increase has primarily been done with the initiation of positions in Siemens, Prysmian, Kingspan, DSV, IMCD and Kion that are directly exposed to infrastructure investments, have significant domestic exposure and demonstrate a good entry point for long term investors. Finally some sectors are now creeping up into our financial screens which did not in the past. For example, while still marginal, a few European banks are now showing traits of profitability and growth which would potentially enable us to buy.

All in all, we see the current environment as an opportunity to reload the compounding engine buying high quality companies and to adapt to the European awakening at attractive entry points. A strong investment case for long term investors.

FP Carmignac European Leaders

FP Carmignac European Leaders A GBP ACC

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 6/7

- SFDR - Fund Classification

- Article -

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0.00%

- Redemption Fees

- 0.00%

- Conversion Fee

- -

- Ongoing Charges

- 0.89%

- Management Fees

- 0.81% MAX

- Performance Fees

- -

Footnote

Performance

| FP Carmignac European Leaders | 18.2 | 27.1 | 13.9 | -14.8 | 13.9 | 6.8 | -3.0 |

| Reference Indicator | 8.8 | 7.5 | 16.7 | -7.6 | 14.8 | 1.9 | 7.4 |

| FP Carmignac European Leaders | + 4.2 % | + 10.3 % | + 9.7 % |

| Reference Indicator | + 7.8 % | + 12.0 % | + 8.1 % |

Source: Carmignac at 31 Mar 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: MSCI Europe ex UK NR index

MARKETING COMMUNICATION

This document may not be reproduced, in whole or in part, without prior authorisation from the Investment Manager. This document does not constitute a subscription offer, nor does it constitute investment advice.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. The information and opinions contained in this document do not consider investors’ specific individual circumstances. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. The information contained in this material may be partial information and may be modified without prior notice. The information is expressed as of the date of writing and is derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. Risk Scale from the KID/ KIID. Risk 1 does not mean a risk-free investment. This indicator may change over time. The recommended investment horizon is a minimum and not a recommendation to sell at the end of that period.

FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the Financial Conduct Authority (the “FCA”) with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

Access to the Company may be subject to restrictions with regard to certain persons or countries. The Company is not registered in North America, in South America, in Asia nor is it registered in Japan. The Company has not been registered under the US Securities Act of 1933. The Company may not be offered or sold, directly or indirectly, for the benefit or on behalf of a U.S. person, according to the definition of the US Regulation S and/or FATCA. The Company presents a risk of loss of capital. The risks and fees are described in the KIID (Key Investor Information Document). The Company’s prospectus, KIIDs and annual reports are available at www.carmignac.com or upon request to the Investment Manager. The KIID must be made available to the subscriber prior to subscription. This material was prepared by Carmignac Gestion Luxembourg SA or Carmignac UK Ltd and is being distributed in the UK by the Investment Manager.

Carmignac Gestion, 24, place Vendôme - 75001 Paris. Investment management company approved by the AMF. Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

Carmignac Gestion Luxembourg, City Link - 7, rue de la Chapelle - L-1325 Luxembourg. Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF. Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 549.

![[Management Team] [Author] Thozet Kevin](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Thozet-Kevi.png?auto=format%2Ccompress&fit=fill&w=3840)