The fashion industry's crossroads: Can sustainable apparel deliver scalable returns?

Rita Wyshelesky explores whether sustainable fashion can overcome cost pressures, regulatory hurdles, and scalability challenges to deliver scalable financial returns, as investors weigh its long-term potential against the dominance of fast fashion

The fashion industry is in the midst of a sustainability crisis. The dominance of fast fashion, particularly ‘ultra-fast-fashion’ brands like Shein and Temu, has shaped consumer expectations for artificially low prices.

The shift to a high-volume, low-cost operating model driven by thin margins within a globalised supply chain is concealing harmful side effects not born by the fashion brands or their customers. Regulation is lax and limited consumer demand for ‘ethical’ clothing means there are few incentives for fashion companies to invest in sustainable practices1.

These structural challenges have dire environmental consequences. On average, garments are worn only seven to ten times before being discarded, approximately 92 million tonnes of textile waste is generated annually, and fashion accounts for nearly 10% of global carbon emissions2.

A series of challenges

Balancing social value with environmental cost

Fast fashion’s environmental costs are well documented but this model also provides low-income households with affordable access to clothing and self-expression. In the UK, average garment prices have fallen by 53% in real terms between 1997 and 2014, expanding access for consumers with limited income3. Consequently, people are buying more. For high-income countries, people typically buy 30-70 new items a year4, well above the five-item level that studies suggest would keep the fashion sector aligned with the 1.5 °C climate target5.

Regulatory efforts to address the industry’s environmental impact have largely focused on cleaning up production but fall short of addressing the core issue: the sheer volume of clothing produced and consumed. Though socially sensitive, the scale of overconsumption must be addressed by lawmakers by placing limits on the quantity of products being produced.

Slow-fashion recession

Global fashion revenues are forecast to have a compound average growth rate of only 2–3% over the next five years, down from pre-COVID levels of 5–6%6. Inflationary pressures, trade uncertainty and declining consumer confidence are compressing both volumes and margins. US tariffs alone mean fashion brands and retailers are anticipating prices will rise by as much as 20%7.

This economic downturn has hit ‘slow’ fashion8 particularly hard. Rising costs for sustainable materials and fair wages are squeezing profit margins, which already average 20% compared to fast fashion's 60%9. Sustainable fashion brands have suffered as a result. DAI and Mara Hoffman closed and People Tree restructured, liquidating its UK business.

Impending regulatory hurdles

The regulatory landscape is shifting from voluntary disclosure of environmental impact to enforceable compliance. 10Extended Producer Responsibility (EPR) laws in the EU will require brands to fund and manage textile waste recovery, with country-specific systems complicating compliance. The Ecodesign for Sustainable Products Regulation (ESPR) mandates a Digital Product Passport (DPP) by 2030. Whilst the final requirements for the DPP have not been released yet, it is expected to include data on carbon footprint, recycled content and supply chain information – some of which companies themselves may not have yet.

Whilst regulations are heading in the right direction, they increase financial and logistical burdens for companies. It remains unclear if companies can comply on time, or if these regulations will ultimately provide an edge for sustainable businesses in the form of financial returns.

Sustainable solutions?

Despite these challenges, there are efforts to tackle the sustainability problem, but these solutions vary in scope and practicality.

Textile recycling: growing but costly

Textile recycling, often viewed as a circular solution to the industry’s waste challenge remains capital-, technology-, and labour-intensive. Manual sorting, mixed-fibre disassembly, and the removal of non-textile components make the process economically unviable without significant subsidy11.

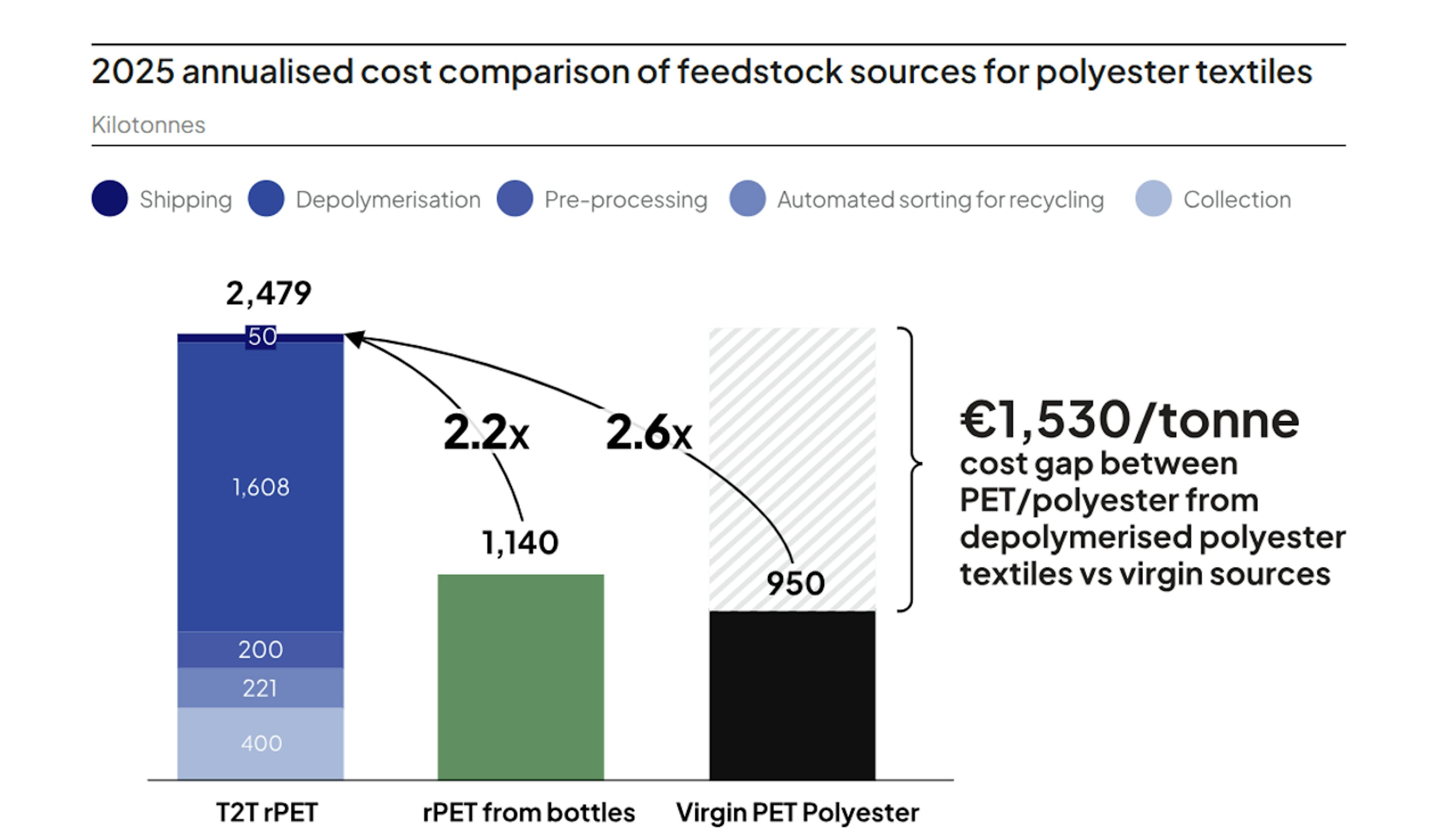

Chemical recycling, which involves breaking down textiles into solvents, thus enabling continuous recycling of old clothes, offers promise but comes at a premium. Current estimates place costs at 2.6x that of virgin polyester12, making it an unfavourable choice in a tight-margin industry. To scale European recycling infrastructure by 2030, an estimated €6–7 billion in capital is needed13. Textile recycling companies like Syre, Circ, and Reju have announced plant expansions in France, Vietnam, and the Netherlands, but planned volumes remain a tiny fraction of the overall textile market. Additionally, companies still remain dependent on securing significant financing from a combination of private equity, venture capital and strategy partnerships with fashion giants like H&M or Inditex.

Furthermore, Renewcell's bankruptcy in 2024 (now renamed Circulose) cast a shadow over the sector, highlighting the volatility of scaling underfunded technologies in a cost-sensitive market14.

‘Recycled’ polyester is also becoming more popular as a seemingly sustainable alternative given polyester’s dominance in fashion production. Polyester is used in over 50% of global fashion output because it is long-lasting, inexpensive, and versatile. But it is also oil-based, emissions-intensive, and rarely recycled15. The challenge with recycled polyester is that over 99% of it is made from PET bottles, not textile waste16. This diverts resources from the food and beverage sector, where they can normally be recycled up to 10 times17.

As demand from multiple sectors converges, competition for raw materials18 and price volatility are unavoidable. Without a credible shift to fibre-to-fibre recycling or biobased alternatives, the industry risks supply insecurity alongside environmental backlash.

Furthermore, the low price of sorted used garments undercuts processing costs, straining reuse and recycling businesses and affecting affordable, sustainable clothing.

While textile recycling has some environmental downsides it is a step in the right direction. And companies like Fast Retailing (Uniqlo's parent) have even found new uses for unrecyclable materials, such as insulation and soundproofing.

Next-generation material: high potential, high risk

Biobased materials that originate (partially or wholly) from biological sources, such as plants, animals, or microorganisms are now serving as alternatives to conventional materials in multiple industries, including fashion.

Scaling the use of next-generation materials in fashion faces significant technical and operational hurdles, not to mention the significant capital requirements (approx. $10–15 million per innovation cycle largely funded via venture capital and corporate partnerships). There are also technical concerns regarding durability, performance, and ability to integrate with mass manufacturing systems19.

Although there are challenges, several brands are committing:

- Stella McCartney integrates grape-based leather and wood-pulp fibres across her line.

- H&M Group and Inditex have inked multi-year deals with textile innovators like Infinited Fiber and Spinnova.

- GANNI is phasing out virgin leather in favour of plant-derived substitutes.

Despite momentum, these materials remain a fraction of total market volume and rely on brand-led uptake to survive.

Investor lens: waiting but watching

There are many structural inefficiencies and overlooked practices in the global fashion industry—particularly in regard to sustainability, accountability, and regulatory alignment. Overcoming these barriers will require coordinated efforts across policy, finance, innovation, and consumer engagement to build a truly circular fashion ecosystem. Too often, industry reports focus on marketing-led narratives rather than the tangible, measurable impact data that will truly define progress. To understand the real trajectory of the industry, investors must take a more critical and informed stance.

Today, we have limited exposure to the fashion industry in our funds for several reasons:

- The sustainable apparel sub-segment remains too small—representing just ~6% of the total global apparel market.

- The wider industry remains highly fragmented, and many of the largest players continue to lag behind on meaningful sustainability action, particularly in key areas such as Scope 3 emissions transparency, material circularity, water footprint disclosure, and supplier-level traceability.

- Inditex and other large-cap fashion retailers are showing signs of stretched valuations, with share prices down over 10% year-to-date and limited upside ahead, as slowing growth, rising input costs, and intensifying competition make their current valuation multiples increasingly difficult to justify.

Nevertheless, we believe, over time, the conjunction of binding regulation, investor pressure, maturing disclosure frameworks, and, potentially, shifts in consumer behaviour will accelerate structural change. We expect ESG transparency and climate-aligned metrics to become standard components of how brands are valued and financed.

When that inflection point arrives, and the industry’s leaders begin to align their business models around traceable, measurable sustainability outcomes, we will reconsider the investment case.

1Sustainable practices are defined as: using biodegradable or recycled materials, promoting fair labour practices, reducing waste, and encouraging mindful consumption.

210 Concerning Fast Fashion Waste Statistics | Earth.Org

3Consumer Prices in the UK: explaining the decline in real consumer prices for cars and clothing and footwear

4https://australiainstitute.org.au/post/australians-revealed-as-worlds-biggest-fashion-consumers-fuelling-waste-crisis/

5Hot_or_Cool_1_5_fashion_report_.pdf

6Global Apparel Industry Statistics (2025) | UniformMarket

7https://www.just-style.com/news/us-tariff-joor-study

8Slow fashion focuses on producing lower volume, higher quality garments, prioritising fair labour practices, safe working conditions, and environmentally friendly materials and production processes.

9https://tuniq.co.uk/pages/price-breakdown-for-ethical-fashion

10Full overview of the EU textile strategy and regulations

11https://www.sciencedirect.com

12https://www.systemiq.earth/reports/the-textile-recycling-breakthrough/

13Circular fashion in Europe: Turning waste into value | McKinsey

14Why Renewcell failed | Trellis

15Fashion Waste Statistics & Facts | Textile & Clothing Waste Facts

16https://www.systemiq.earth/reports/the-textile-recycling-breakthrough

17HDPE Plastic Can Be Recycled Multiple Times, Study Shows

18European Parliament, “Plastic Waste and Recycling in the EU: Facts and Figures,” European Parliament website, December 19, 2018.

19Scaling Next-Gen Materials In Fashion: An Executive Guide - Fashion for Good.

This communication is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF). “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the individual’s situation.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication.

UK: This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd and is being distributed in the UK by Carmignac Gestion Luxembourg.

Carmignac Gestion - 24, place Vendôme - 75001 Paris. Tel: (+33) 01 42 86 53 35 – Investment management company approved by the AMF. Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

Carmignac Gestion Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg. Tel: (+352) 46 70 60 1 – Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF. Public limited company with share capital of € 23,000,000 - RC Luxembourg B 67 549.