As portfolio manager for the Carmignac Global Bond strategy, Abdelak Adjriou, continually seeks to find opportunities in areas of the bond market that can generate alpha. Given current geopolitical tensions in the region, it is easy to overlook Eastern Europe (circa. 15% of the Fund as of end of April 2025). In this article, Abdelak considers which investment prospects exist specifically in Poland, Hungary and Romania, despite the ongoing war in Ukraine.

Whilst talks between the US, Ukraine and Russia continue over securing lasting peace in Ukraine, the impact across Eastern Europe is becoming increasingly clear. Risks undoubtedly remain however opportunities are abundant across the region.

As the Ukraine-Russia conflict enters its third year, progress towards a ceasefire has advanced, following the proposed initiative by the United States, whilst Europe still seeks its place at the negotiating table. Russia’s true appetite for de-escalation remains to be seen, but this will undoubtedly affect the investment prospects of Ukraine’s neighbours, most notably its closest ones – Hungary, Poland and Romania.

On the economic front, the US administration has unveiled a series of reciprocal tariffs, imposing a minimum 10% tariff on all exporters. Certain trading partners will face even higher tariffs, initiating a potentially perilous situation for the global economy. Although these tariffs may have limited impact on Central and Eastern Europe (CEE), due to their relatively small trade flows with the US — only 1.5-3.5% of the region's domestic gross value added is linked to the US — the overall direction of global foreign trade policies is a more alarming signal. CEE has clearly benefited from globalisation and integration into global supply chains. Therefore, the overall impact on the European Union must be closely monitored, as it is a key market for CEE exports, and the sensitivity of CEE GDP to fluctuations in the Euro area can average around 1% through economic cycles1.

Nevertheless, we believe there are reasons for optimism in the medium term. The German government's historic fiscal shift should drive growth momentum in the region whilst minimising the impact of tariffs to some extent. Although more pertinently, each of these countries has its own idiosyncratic challenges and potential, whether triggered by potential political change or shifting fundamentals. The task for an active, flexible, go-anywhere global bond fund like ours is to sift through the noise and take advantage of those areas where value can be created for our clients. This flexibility allows us to think outside the box and go beyond traditional management to seek out sources of alpha regardless of where we are in the economic cycle.

Emerging market debt is a particularly interesting example. The heterogeneous nature of this investment universe offers opportunities that are often uncorrelated to the economic cycles of developed countries, while at the same time offering attractive valuations. At present, average yields in the CEE region show a premium of 300 basis points over German debt, with fundamentals such as debt levels often well below those of certain eurozone countries.

Hungary for change

One of the more open Central and Eastern European (CEE) states, Hungary is firmly plugged into the EU economic machine. Indeed, the EU, and Germany in particular, are the country’s major export destinations. Hammered by the global financial crisis, a multi-year deleveraging process ensued. The result? A much more balanced economy. However, the economic costs of the pandemic, political unrest and the energy crisis that followed Russia’s invasion of Ukraine have set the country back once again.

Indeed, Hungary experienced the worst inflation shock in the region, with a peak of around 26% and food prices increasing by 50% on a year on year basis2. The effects of this struggle are that inflation is a political hot potato, and there is a firm commitment to monetary stability. This means the central bank's monetary policy remains very strict (rate cuts held off as long as possible), while efforts are now focused on preserving the stability of the Hungarian forint because of the looming elections.

Meanwhile, Prime Minister Victor Orbán is in his fourth term and remains a figure of conflict between the EU and Russia – he is also on good terms with US President Donald Trump – but in the form of Peter Magyar, leader of the new party Tisza, we believe that Orban faces a genuine leadership challenge come April 2026.

At the fundamental level, Hungary has seen one of the best improvements in its primary balance and current account balance in Europe over the past decade or so. The case for investing in Hungarian bonds is based on the country’s strong commitment to lower inflation and monetary stability, tight monetary policy and a disciplined fiscal approach.

Hungary’s balance indicators are improving significantly

A Bucharest bounce?

As one of the least developed states in the EU, the upside potential for Romania is huge. But like much of the CEE region, it has its fair share of challenges.

Among these challenges, Romania has seen economic growth significantly slow, the result of manufacturing slumps in Europe and an overvalued exchange rate. Indeed, the emphasis on reducing inflation, together with the large stock of foreign currency-denominated private sector debt, has historically led the central bank to maintain some stability of the Leu against the euro through market interventions to smooth volatility. As a result, GDP growth was below 1% in 2024 and is expected to be slightly below 2% in 2025. Meanwhile, its fiscal deficit has widened drastically to 8.7% of GDP3, the highest among the 27 member states, on the back of pension and wage increases in an election context, and a return to pre-COVID levels is not necessarily on the cards.

On the positive front, Romania is of major NATO significance; it holds a strategic position with three NATO bases, including the largest one in Europe (being built by the US) – this boosts the country’s geopolitical importance and potential for EU leniency. At the same time, Romania is nearly self-sufficient in energy – with expectations of becoming a gas exporter within two years – and is a significant exporter of agricultural commodities.

And then there is the political situation; having won the first round of the initial ballot ahead of the May elections, the far-right pro-Russian candidate Calin Georgescu has now been barred from running by the Constitutional Court, owing to him violating ‘the very obligation to defend democracy’.

The new elections have just concluded, with Nicușor Dan, the mayor of Bucharest, emerging victorious with around 54% of the vote. This result came as a surprise, given that he had initially been ranked third in the polls before the first round, and had finished second after it, 20 points behind the far-right candidate, Georges Simion (41% vs. 21%). This outcome is clearly the most market-friendly and has generated a positive reaction from financial markets. The vote shows that the majority of Romanians want to continue on the path towards the EU and NATO without shifting to the right. The result is also positive for Ukraine, as Russia's hopes of turning another neighbour against it have not been realised, which could facilitate the ceasefire process.

However, Dan's victory is only the first step on a difficult road. He will have to form a government, which will be challenging given the rivalries between the parties. Once formed, the government will need to swiftly adopt a budget plan to address the unsustainable public deficit. Dan will likely have to renege on some of his campaign promises due to the fiscal situation. While these elections bring welcome temporary relief, we believe that the long-term risks remain high, and we are still watching for signs of political will to get the macroeconomic policy mix right.

Romania budget balance as % of GDP. A return to 3% is not expected anytime soon

Pole position...

Poland is the largest and most diversified economy in CEE, and its broad domestic demand and competitive exports base have provided a cushion during various external downturns. The country has been among the largest recipients of EU funds since accession, which has been the key driver for growth. Meanwhile, World Bank data suggests Poland’s GDP-adjusted income will overtake that of Japan by 2026. The Polish economy is expected to grow from 2.6% in 2024 to 3.1% in 20254, driven by consumer spending and increased investment due to EU funds as for the 2021 to 2027 EU budget period, Poland is eligible for nearly €130bn (on average over 3% of GDP per annum) in grants from the EU Recovery Fund and the EU Structural and Cohesion Fund5.

Elsewhere, the political transition under Prime Minister Donald Tusk has ushered in a more market- and EU-friendly coalition government, helping to quicken the EU payments progress to Poland, bringing in over €20bn by early 2025 and boosting investor confidence.

The main challenge facing the country is its large budget deficit (6% of GDP in 2024) – the consequence of an eight-year populist fiscal stance by the previous government – and the country’s heavy defence burden, which is set to rise to 4.7% of GDP in 2025 from 4.2% of GDP in 20246.

Finally, inflation is also an issue that has complicated relations between the government and the governor of the National Bank of Poland (NBP), Adam Glapiński, resulting in the bank's non-supportive growth stance. Indeed, the absence of fiscal tightening, the removal of energy price caps and the reduction in VAT on food and excise duties justified this wait-and-see attitude, in his view.

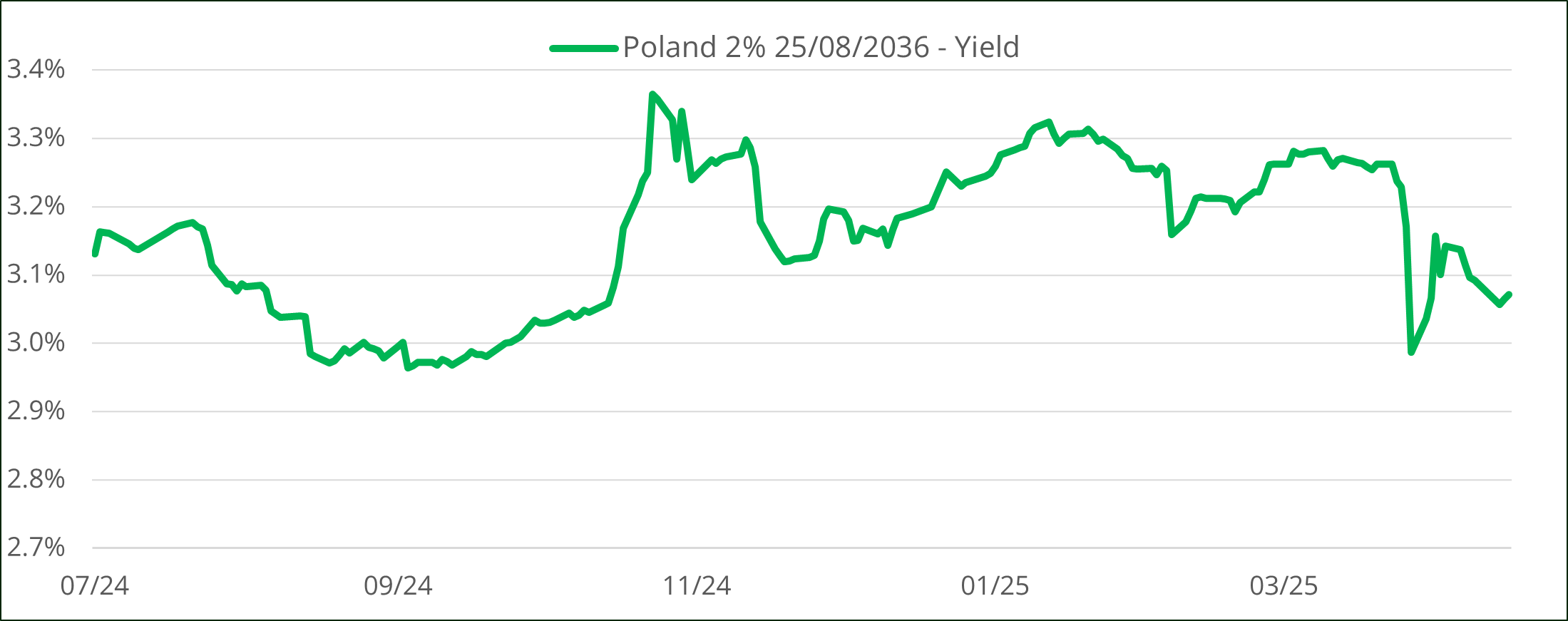

At the April meeting, however, the Governor made a complete U-turn, taking the market by surprise. Glapinski attributed the dovish shift to a "radical change" in the outlook. Revisions to the CPI basket have led to "significantly lower" inflation at the start of the year than originally reported, 4.9% vs. 5.3%. The slowdown in wage growth to single-digit rates, still high but "no longer in double digits", was another factor that influenced the thinking. The NBP now forecasts inflation at 4.5% in Q2, 3.5% in Q3 and 4.2% in Q4, down sharply from the March Inflation Report projections of 5.2%, 4.1% and 4.8% respectively7.

Some may consider the NBP's change of direction between March and April abrupt, but this decision could not have been better timed to cushion the shock of US tariffs on the economy. This decision, combined with Trump's announcements on tariffs, triggered a significant rally in short-term rates, exacerbated by a decline in rates across the globe.

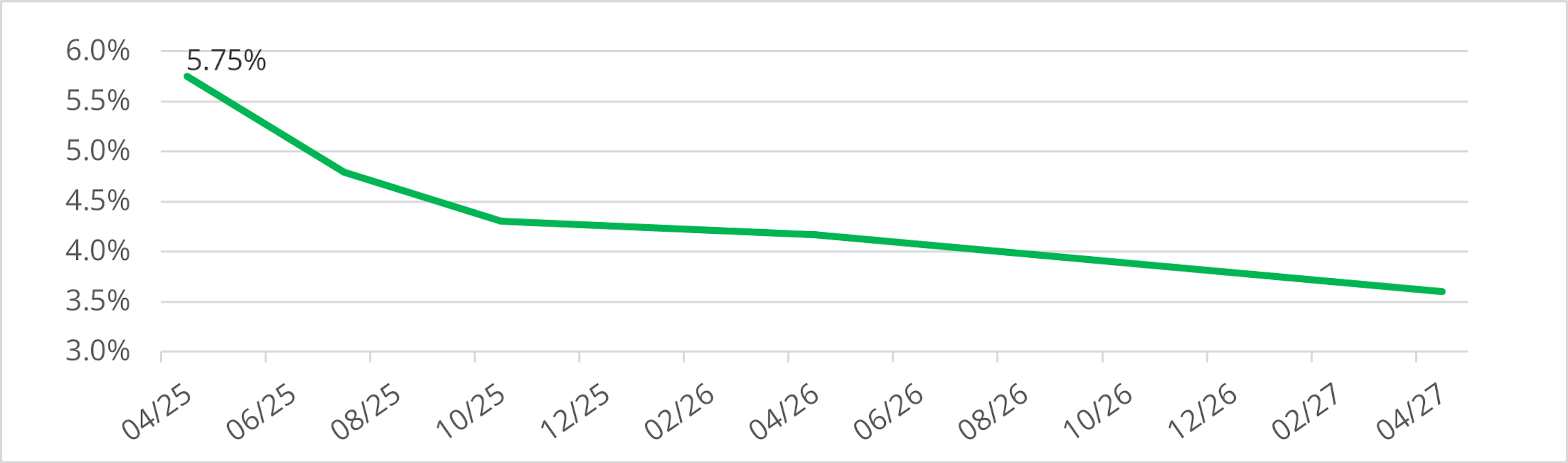

As a result, the market has revised its NBP rate profile downwards and now expects a rate slightly below 4.5% at the end of 2025, compared with the current policy rate of 5.75%.

Poland forward policy pricing. Market are pricing close to 145bp of cuts this year

EM debt in general, and Eastern European countries in this case, offer valuable diversification from their developed market counterparts. Underpinned by diversified economies with relatively strong fundamentals, this region provides a welcome hedge against global economic shocks, particularly in a volatile environment caused by the introduction of tariffs, the direct impact of which has been limited in the region, while generally offering higher yields.

However, it is important to consider the specific risks associated with these investments, with Romania being a good example. Political risks, currency fluctuations and economic vulnerabilities are all challenges for the management team, which means that a rigorous framework for analysing the specific economic and political conditions of each country is essential.

In terms of implementation, the flexibility of the Global Bond strategy offers a particularly wide range of options in terms of instruments such as investments in local interest rates, bonds denominated in hard currencies (EUR or USD) and, of course, currencies, each with its own dynamics. Abdelak will therefore favour one or other of these sources of performance, taking into account various factors such as macroeconomics, valuations, technicals and market sentiment, while keeping an eye on the overall balance of the portfolio.

Country thesis & implementation

FP Carmignac Global Bond

FP Carmignac Global Bond A GBP ACC HGD

- Recommended minimum investment horizon

- 2 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification

- Article -

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0.00%

- Redemption Fees

- 0.00%

- Conversion Fee

- -

- Ongoing Charges

- 0.70%

- Management Fees

- 0.62% MAX

- Performance Fees

- -

Footnote

Performance

| FP Carmignac Global Bond | 5.8 | 6.6 | 0.0 | -2.5 | 4.3 | 2.3 | 1.4 |

| Reference Indicator | 3.7 | 0.6 | 0.6 | -11.8 | 0.5 | 2.8 | -1.4 |

| FP Carmignac Global Bond | + 1.9 % | + 2.7 % | + 3.0 % |

| Reference Indicator | - 2.1 % | - 2.9 % | - 1.0 % |

Source: Carmignac at 31 Mar 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: JPM Global Government Bond index

Marketing Communication. Please refer to the KID/KIID/prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

The decision to invest in the promoted fund should take into account all its characteristics or objectives as described in its prospectus.

This communication is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF). “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice.

This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA. Company. The risks, fees and ongoing charges are described in the KIID/KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds’ prospectus, KIDs, KIIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management Company. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in French, English, German, Dutch, Spanish, Italian at section 5 of "regulatory information page" on the following link: https://www.carmignac.com/en_US/regulatory-information.

Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

UK: FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the Financial Conduct Authority (the “FCA”) with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in the UK in respect of the Company. Carmignac Gestion SA, an investment management company approved by the AMF has been appointed as sub-Investment Manager of the Company.

Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon.

Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page.

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35 Investment management company approved by the AMF. Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel : (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 549.