Trump 2.0: Make Emerging Markets great again

Initial fears of the impact of US trade policy on emerging markets (EMs) were sizeable, but now that the dust has started to settle, it seems EMs are well positioned to thrive in this new reality of higher tariffs, according to Xavier Hovasse and Naomi Waistell, co-managers of the FP Carmignac Emerging Markets Fund.

The old global structures are crumbling.

Gone are the days of Asia as merely the outsourced manufacturer of the West, Europe the home of luxury and tourism, and the US tech industrial revolution. Not so long ago, investors needed only to invest in the US and Europe to garner robust performance. EM wasn’t even a consideration, consisting of underperforming markets, political risk, and self-destructive political leadership.

No longer, though. The re-election of Donald Trump has given investors globally a wake-up call, and it is making EM great again.

The Trump effect

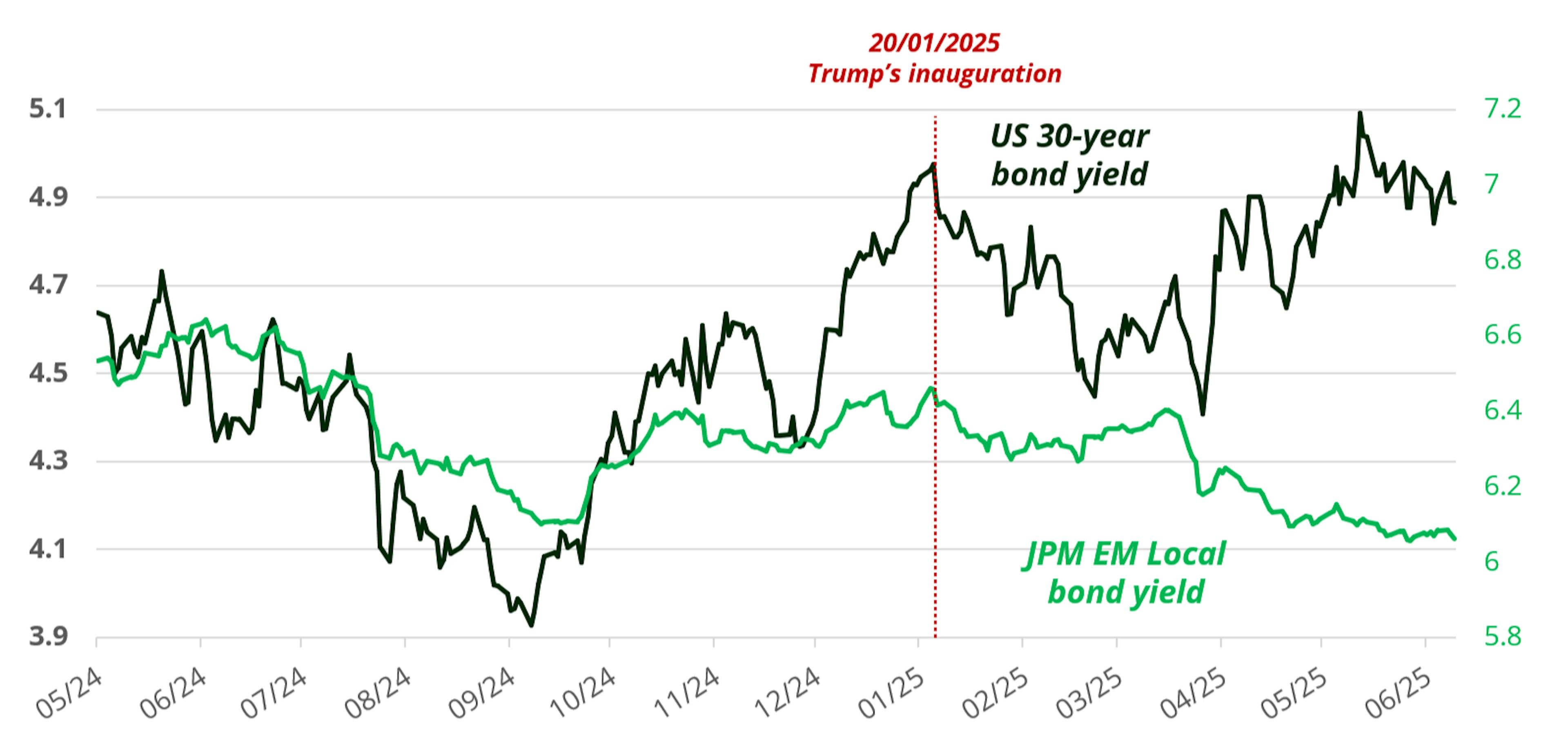

Trump’s second term not only started with a bang; it tore up half a century of global norms. The risk-free rate – long the preserve and luxury of the US – is gone. Political risk is now a US phenomenon, while institutions have been challenged and, in so doing, weakened. In short, the US is now behaving like an emerging market. Normally, in a risk-off market like today, the risk-free assets – US Treasuries and the US dollar – are the strongest performing asset class and currency. But we are witnessing the polar opposite: Treasury yields are rising, US equity markets are flailing, and the dollar is weakening (it has fallen versus all EM currencies in 2025, see charts below). Investors are selling the US.

The result is that investors are considering deploying more capital outside of the US, and into EM. Trump’s attitude has certainly been a trigger but there is a greater force: it has also coincided with the resurgence of China.

US Dollar index vs JP Morgan EM FX index since 2010

US vs EM local bond yields

China’s evolution

10 years ago, China would have been recognised for its rapidly growing economy and manufacturing strength, but you might have questioned the quality of its products. It was not comparable to US or European equivalents. Not anymore.

China now has some of the leading scientists and engineers in the world– the product of its stellar education system – and has significantly upgraded its industrial capacity and capability. The country is no longer the manufacturing hub of trainers and denim – they outsource this to Cambodia and Vietnam – but instead leads the world on renewable energy, electric vehicles and artificial intelligence (AI). China is taking advantage of new technology to dominate global manufacturing.

Interestingly, the global manufacturing chain for renewable energy is dominated by China, so the greater the adoption of renewables in the West, the more China will benefit. Furthermore, China is now the largest car exporter in the world, with BYD selling more cars in Europe than Tesla. China’s auto dominance threatens the very existence of Germany’s car industry, with German manufacturers significantly lagging on EV battery range and charging speeds1.

“We are now at the point where the world realises that China is no longer merely a low-cost manufacturing hub; it is now much more sophisticated and can dominate global manufacturing in almost every way, even in biotech, healthcare and petrochemicals.”

The AI leap

Two years ago, Nvidia went from being a frankly boring semiconductor equipment business to the most valuable company in the world. AI had finally arrived. Of course, the assumption was that the US would naturally dominate AI, much like Microsoft and Google ruled the tech space previously, and OpenAI looked set to follow in their footsteps.

Fast-forward two years and DeepSeek blew that assumption apart; it now seems likely that it is a serious contender in the AI race.

As the world’s second-largest economy, China has an incredible education system centred around science and maths, and a government that invests at scale. Semiconductor chip export controls from the US, designed to limit China’s AI capacity, have failed. Nvidia CEO Jensen Huang recently warned that Chinese AI firms are now ‘formidable’, developing their own semiconductor manufacturing facilities at pace. China has been underestimated, and it is naïve to think that it can’t be self-sufficient in this space.

Take almost any industry and China is incredibly well positioned off the back of sustained long-term human and capital investment. Furthermore, it is the number one trading partner for almost all EMs.

Our Chinese exposure is focused largely on tech and consumption; this is a country where consumption as a share of GDP is the lowest among the largest countries in the world. A rebalance is due.

China’s global market shares in advanced industries

Asia’s attraction beyond China

Without doubt, tech is a major attraction for investors considering Asia. Historically, the ideas and design were in the US, while the manufacturing was outsourced to Asia. Now, 100% of Nvidia’s graphics processing units (GPUs) are manufactured by Taiwan’s TSMC, and the bulk of its high bandwidth memory products come from South Korea’s Hynix. The AI revolution will be powered by Asia, and the US knows this. The Trump administration is encouraging these leading firms to invest in the US and manufacture there. This strategy is starting to work, with TSMC having already committed to investing US$150 billion in the US, aided no doubt by Taiwan’s strained relationship with China.

“While plenty of the focus around Asia is centred upon China, the region at large continues to thrive. Asia continues to be a favoured hunting ground for us, with significant exposure across the e-commerce, fintech and healthcare sectors.”

Indian impetus

Where does India sit in this Trump 2.0 world?

We view India through the same lens we viewed China 20 years ago. India’s economic model is a form of economic governance that relies on a long-term view, political stability, and the ‘Made in India’ mantra. It has a well-educated, largely English-speaking population and an industry protected by government – a cornerstone of Prime Minister Narendra Modi’s leadership policy.

The Indian economy is set to grow at 6%-7% annualised over the next 10 to 15 years2, and in the near-term, India is a beneficiary of the US/China tensions.

We have a high-conviction view that India will succeed in the long term. There are a number of well-managed, investable companies in India which don’t have the same overcapacity problems as China.

Latin America, the winner of Trump's policies

No Mexican stand-off

Some EM countries, like Mexico, benefit from the trade wars, given its attractiveness for US ‘nearshoring’ and a good political relationship. Mexican President Claudia Sheinbaum has been strengthening this in recent times, cooperating on increasing security along the US/Mexico border and ultimately helping Trump to progress his agenda.

Sheinbaum is more politically moderate than her predecessor which should be positive for the economy and asset prices. Our focus is on domestic names which benefit from nearshoring, industrial REITs, and local banks.

A Brazilian boon?

Elsewhere in Latin America, we continue to be bullish on Brazil, and increasingly optimistic around the prospects for Argentina. Brazilian equities, in our view, are very cheap, and in particular, utilities given the strong infrastructure needs in the country. Of the world’s largest countries, Brazil has the highest real rate, above 7%, making both the Brazilian real and real-denominated debt attractive. Power utilities companies offer on top of the Brazilian sovereign yields an additional 5% equity risk premium – therefore offering overall close to 12% real yields.

Rates need to come down, but with elections next year and a potential change of regime, there is the opportunity for better fiscal and economic development. We believe that the prospects for Brazil are very positive, with oil production rising, agricultural production growing, undervalued assets and a population with a strong entrepreneurial spirit.

Meanwhile, in Argentina, there has been a seismic improvement in the country’s fiscal position, moving from a large deficit to a surplus under the leadership of the mercurial Javier Milei, with sovereign bonds having staged an impressive recovery. Risks remain, of course, and mid-terms loom this autumn, but we keep our cautiously optimistic view from an investment perspective.

FP Carmignac Emerging Markets A GBP ACC

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 6/7

- SFDR - Fund Classification

- Article -

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0,00%

- Redemption Fees

- 0,00%

- Conversion Fee

- -

- Ongoing Charges

- 0.95%

- Management Fees

- 0,87% MAX

- Performance Fees

- -

Footnote

Performance

| FP Carmignac Emerging Markets | 13.6 | 63.0 | -15.6 | -9.5 | 7.2 | 0.9 | 4.0 |

| Reference Indicator | 8.8 | 14.7 | -1.6 | -10.0 | 3.6 | 9.4 | 1.0 |

| FP Carmignac Emerging Markets | - | - | - |

| Reference Indicator | - | - | - |

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: MSCI EM NR index

Carmignac Portfolio Asia Discovery FW GBP Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 5/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0,00%

- Redemption Fees

- 0,00%

- Conversion Fee

- -

- Ongoing Charges

- 1.50%

- Management Fees

- 1,20% MAX

- Performance Fees

- -

Footnote

Performance

| Carmignac Portfolio Asia Discovery | 21.2 | 24.1 | -6.9 | 5.2 | 6.5 | 20.0 | -17.2 | 10.9 | 25.1 | -6.6 |

| Reference Indicator | 23.5 | 22.9 | -10.7 | 8.0 | 11.3 | 13.8 | -6.7 | 12.2 | 4.8 | -3.2 |

| Carmignac Portfolio Asia Discovery | - | - | - |

| Reference Indicator | - | - | - |

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: 1525_CAREMDS_LX_GBP

Articles that may interest you

FP Carmignac Emerging Markets: Letter from the Fund Managers - Q2 2025

FP Carmignac Emerging Markets: Letter from the Fund Manager

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com/en, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.com/en-gb, or upon request to the Management Company, or for the French Funds, at the offices of the acilities Agent, Carmignac UK Ltd, 2 Carlton House Terrace, London, SW1Y 5AF. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.com/en-ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.

For Carmignac Portfolio Long-Short European Equities: Carmignac Gestion Luxembourg SA in its capacity as the Management Company for Carmignac Portfolio, has delegated the investment management of this Sub-Fund to White Creek Capital LLP (Registered in England and Wales with number OCC447169) from 2nd May 2024. White Creek Capital LLP is authorised and regulated by the Financial Conduct Authority with FRN : 998349.

Carmignac Private Evergreen refers to the Private Evergreen sub-fund of the SICAV Carmignac S.A. SICAV – PART II UCI, registered with the Luxembourg RCS under number B285278.