After three consecutive years of record-breaking performance in the bond markets, the outlook for 2026 appears more uncertain. This uncertainty is fuelled by high valuation levels on risky assets and by visible economic and geopolitical imbalances. However, these divergences may represent investment opportunities for flexible bond strategies that seem advisable to consider before a potential end of the current economic cycle.

1) Growth revised upward but increased tensions persist

- While investors have taken note of the fiscal stimulus intentions of eurozone countries, leading to a widespread increase in long-term rates across the old continent, the outlook for the United States was much more volatile in 2025 (see figure 1).

- Indeed, the arrival of Donald Trump in the White House sparked a wave of concern about the growth potential of American companies and the labour market, exacerbated by the shutdown of the American administrations, thus depriving investors of visibility to assess the resilience of the American economy at the end of the fiscal year.

- Consequently, U.S. long-term rates decreased by 40 basis points in 2025, despite economic growth peaking at 4.3% in the third quarter, and a labour market showing certain resilience up to this point.

- Enthusiasm also seems to prevail over U.S. short-term rates after three consecutive rate cuts made by the Federal Reserve (Fed) in 2025, with a market consensus forecasting between two and three rate cuts for 2026.

- Given that inflation continues to evolve above the Fed's target, whilst economic stimulus should continue to remain strong before the November midterm elections, and that geopolitical news remains turbulent, it seems wise to position for a rise in both short and long rates considering current levels of U.S. rate markets.

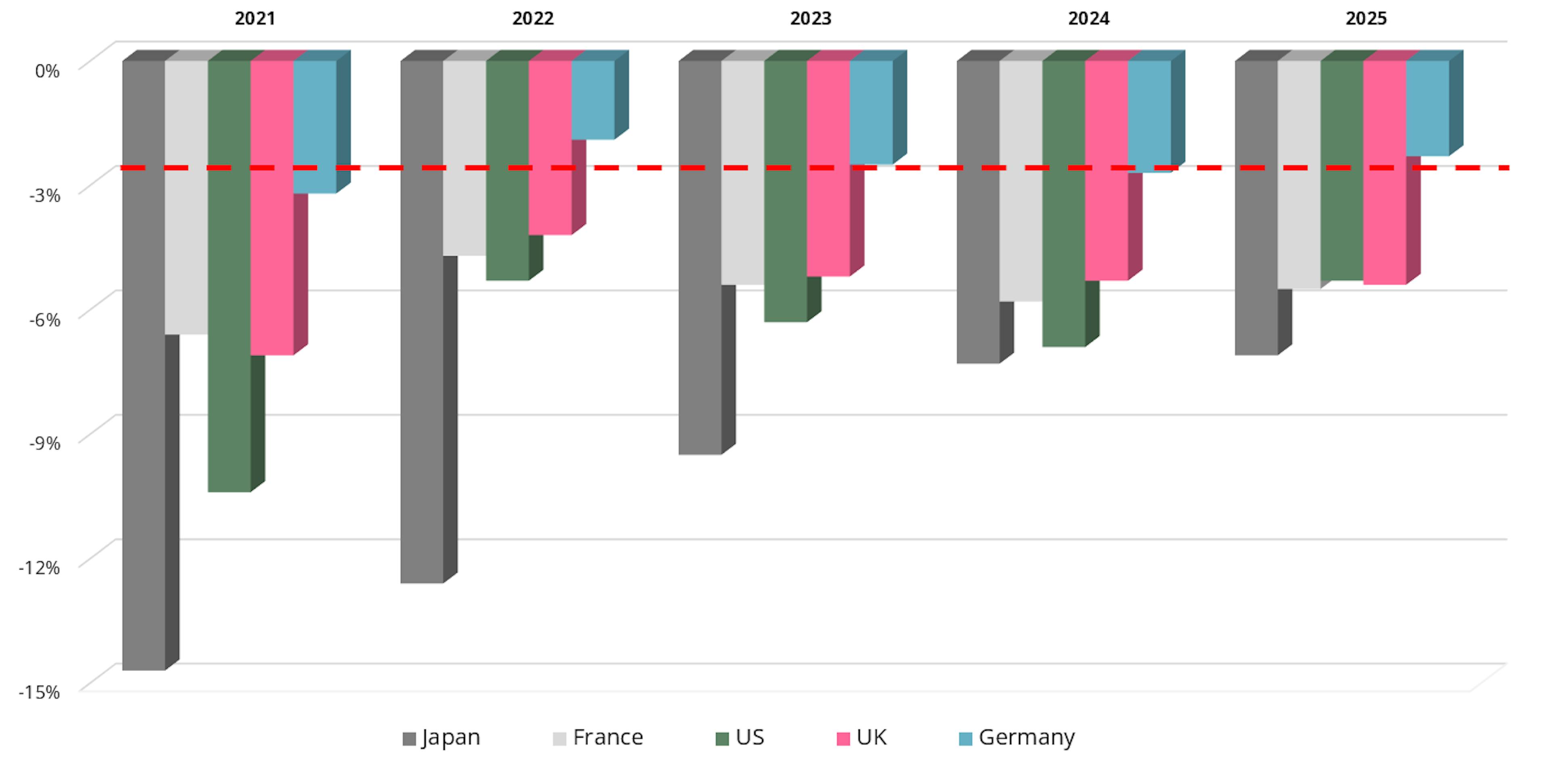

2) Fiscal deficits allows for an extension of the cycle

- The current geopolitical environment leads to costly investment policies for various economies to address remilitarization challenges and intensive trade wars.

- This increase in deficits raises the interest burden of debt for these various states, leading to even more imbalanced budgets and increased bond issuances to finance sovereign debt service.

- We believe that this excess bond supply on the market should be met with limited demand, as the Japanese "carry trade" wanes, less price-sensitive actors such as central banks or pension funds disengage from sovereign bonds, and emerging economies now seem to prefer gold to sovereign bonds of developed countries.

- Although corporates and more broadly risky assets may benefit from this surplus growth generated by these lavish state budget largess, the potential for credit spreads tightening seems limited, both in the corporate debt segments and in emerging external credit and debt as a whole.

- This therefore argues for discretionary selection of credit issuers at this stage of the cycle rather than for an indiscriminate strategy of positioning on risky assets such as high-yield credit on the sole argument that the cycle continues and that returns are present.

- However, this paradigm of increasing sovereign debt levels in developed economies should be considered as an investment opportunity. It will indeed allow active and flexible management to implement curve strategies to potentially benefit from a more marked rise in long rates compared to the short ends of rate curves; and to seek to identify the best among the less favorable in this universe where rate convergence has largely prevailed while economies have followed different trajectories.

3) Emerging issuers benefit from a positive momentum

- In a fragmented and unsynchronized global environment, emerging issuers seem better positioned for the future compared to their developed country counterparts.

- Except for Asia, which continues to suffer from the disappointing dynamics of the Chinese epicentre, emerging countries share common characteristics: a widespread decline in consumer prices, modest but positive growth, and controlled debt levels - adjustments were made more than 10 years ago.

- These same so-called emerging countries also benefit from the balkanization of the global chessboard, with the emergence of new powerhouses exporting raw materials, as well as the repatriation of formerly Asian production chains close to Western consumers, or the emergence of a South American alignment with the Trump administration.

- We currently favour emerging market debt issued in local currency, which offers record carry levels and relevant tightening potential (see figure 3), while central banks have adopted restrictive policies so far to maintain inflation in line with their targets.

- Finally, technical factors are also favourable, with an increase in flows into this asset class, which should support valuations in the coming months.

4) Inflation : alive & kicking

- We believe that the reforms adopted in 2025 by the Trump administration will begin to impact the US economy during the first half of 2026 (see figure 4). While the current inflation level remains close to 3% over the past 12 months, the impact of tariffs on the upcoming rounds of statistics will undoubtedly be bad news for the Fed, which has limited means to mitigate inflation other than adopting a more restrictive stance.

- Besides the implementation of tariffs, we think that the new immigration policy decided by the American administration could lead to increased tensions in the labour market and higher wages. Given the remigration policy and the sharp halt of new immigration, these reforms could heighten the risk of a price-wage spiral, which is generally highly inflationary in the long term.

- Nevertheless, we believe that this scenario represents a relevant investment opportunity as it doesn't seem to be factored in by the market consensus, which aligns with a stable inflation scenario at 2.5% for the coming years. Whenever we observe stronger-than-expected inflation statistics, allocation in inflation-indexed bonds or inflation swaps can generate additional performance.

- We can also extend this trend to the eurozone, where inflation has significantly benefited from the decrease in commodity prices in 2025 but still remains above the 2% target set by the ECB with a certain risk of resurgence for the same reasons of fiscal stimulus and protectionism.

- Given that geopolitical tensions remain high, we believe that inflation-linked instruments can also serve as a macroeconomic hedge in case of potential increases in commodity prices. With crude oil prices returning to January 2021 levels, the upside risk is considerable.

5) An option for the current market configuration: Carmignac Portfolio Flexible Bond

- Given the elements discussed previously, the current environment may initially leave one circumspect or dubious regarding the approach to adopt due to high valuation levels and economic imbalances. But it is precisely action that must prevail over wait-and-see in a context where risk-free returns (monetary, euro funds, or structured products) are generally below inflation.

- In our view, inflation-indexed instruments remain one of the last attractive sub-segments in the bond market, while other corporate and government bonds show limited potential for additional compression. With 20% of the portfolio invested in inflation-indexed bonds and over 300 basis points of duration invested in inflation swaps, Carmignac Portfolio Flexible Bond is well positioned to benefit from sustained inflation in the future.

- Moreover, while conventional bond strategies typically suffer during episodes of inflation resurgence due to consecutive adjustments that can occur on yield curves, the fund’s flexible mandate allows us to adopt a neutral or negative sensitivity through derivative instruments, to take advantage of a rising rate environment.

- This flexibility also manifests in the global allocation of the portfolio within money market assets or through hedging strategies that protect the fund from sometimes excessive valuation levels, particularly in credit, while discretionary capital allocation in a selection of issuers offering attractive risk-adjusted remuneration levels.

- Since the arrival of the co-portfolio management team, Guillaume Rigeade and Eliezer Ben Zimra in July 2019, Carmignac Portfolio Flexible Bond has outperformed the bond markets in all market regimes, with end-of-cycle and contraction phases being particularly generative of relative performance (see figure 5). We believe the fund is well positioned to achieve robust performance in the coming months due to the diversity of its performance drivers and its low correlation with traditional fixed income indices.

Carmignac Portfolio Flexible Bond A EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. The SFDR classification of the Funds may change over time.

Main risks of the fund

Fees

- Entry costs

- 1.00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1.23% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20.00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0.20% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Portfolio Flexible Bond | 0.1 | 1.7 | -3.4 | 5.0 | 9.2 | 0.0 | -8.0 | 4.7 | 5.4 | 4.3 |

| Reference Indicator | -0.3 | -0.4 | -0.4 | -2.5 | 4.0 | -2.8 | -16.9 | 6.8 | 2.6 | 1.3 |

| Carmignac Portfolio Flexible Bond | + 4.8 % | + 1.2 % | + 1.8 % |

| Reference Indicator | + 3.5 % | - 2.2 % | - 1.0 % |

Source: Carmignac at Dec 31, 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: ICE BofA Euro Broad Market index

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com/en, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.com/en-gb, or upon request to the Management Company, or for the French Funds, at the offices of the acilities Agent, Carmignac UK Ltd, 2 Carlton House Terrace, London, SW1Y 5AF. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.com/en-ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.

For Carmignac Portfolio Long-Short European Equities: Carmignac Gestion Luxembourg SA in its capacity as the Management Company for Carmignac Portfolio, has delegated the investment management of this Sub-Fund to White Creek Capital LLP (Registered in England and Wales with number OCC447169) from 2nd May 2024. White Creek Capital LLP is authorised and regulated by the Financial Conduct Authority with FRN : 998349.

Carmignac Private Evergreen refers to the Private Evergreen sub-fund of the SICAV Carmignac S.A. SICAV – PART II UCI, registered with the Luxembourg RCS under number B285278.