Carmignac’s 2026 Sustainable Investment Outlook

Modern economic and market development rests on four enabling pillars: institutional integrity, long stewardship time horizons, evidence-based decision-making and competition. While each is currently under pressure in key regions and industries, there are reasons to be positive. Both the clean-tech transition – enabled by cheap Chinese technology and EU regulatory clarity – and encouraging improvements in emerging market corporate governance present opportunities in an increasingly turbulent environment.

Evolution of ESG

The definition of ESG has significantly evolved. While in the past it was often reduced to renewables, ethics and exclusions, there has been a shift towards a more holistic approach involving ESG integration. Today, it is seen as a meaningful factor in enhancing risk-adjusted returns. This evolution is ongoing and will continue to mature through 2026.

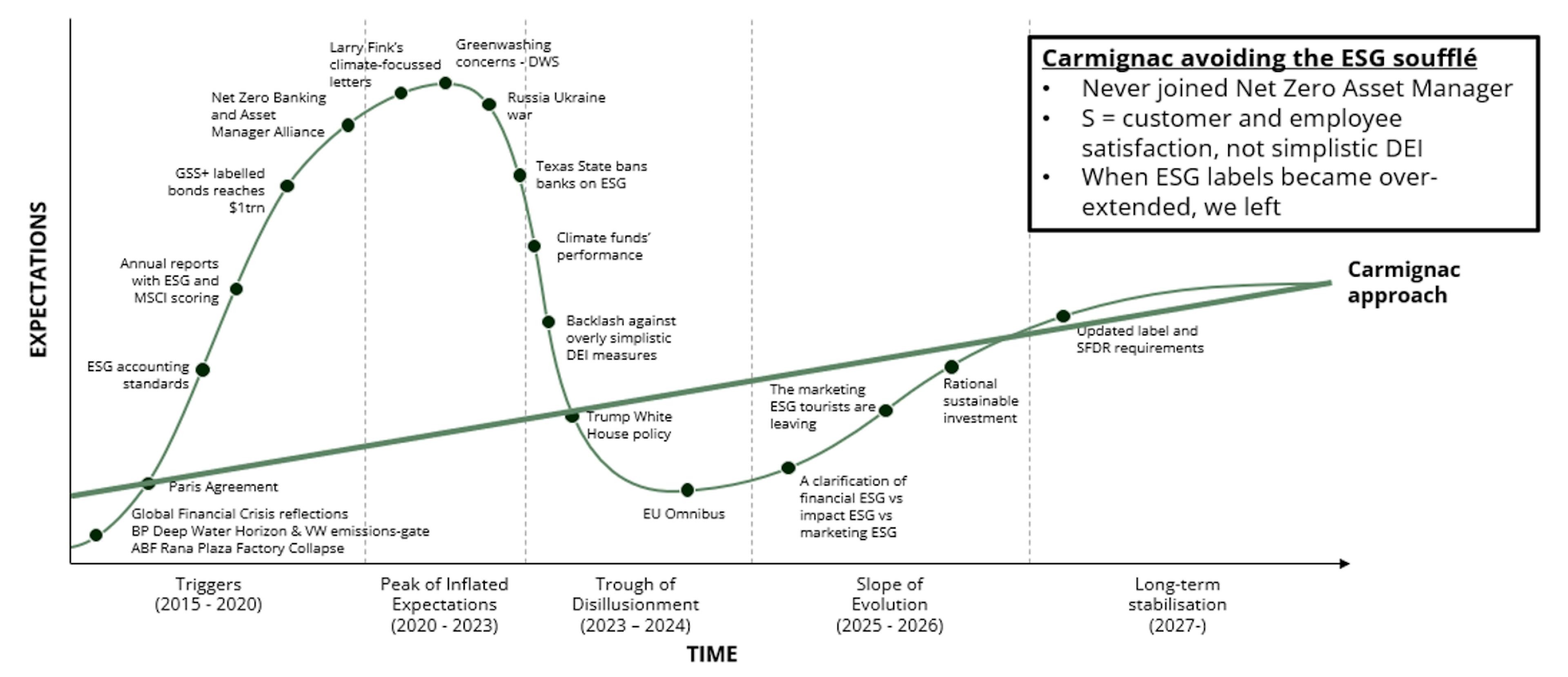

Figure 1: the evolution of ESG investing1

ESG turned from a useful alternative dataset as ‘big data' happened, to a product - resulting in oversimplification and extended claims - followed by a backlash and now, we’ve reached a new equilibrium.

A DECADE-LONG INDUSTRY HYPE CYCLE

A shift from ESG to rational sustainable investment

We’re witnessing ESG’s evolution towards investment system stewardship. As active managers, we approach sustainable investing through two complementary lenses: an “alpha2 partner” focus that uses issuer level ESG analysis to manage risks, uncover opportunities, and generate alpha through stock selection, engagement, and thematic insights. At the same time, we act as a “beta3 steward” by working to help avoid the weakening of systemic foundations – such as climate stability and AI safety – that shape long term portfolio outcomes and cannot be diversified away.

Environmental outlook

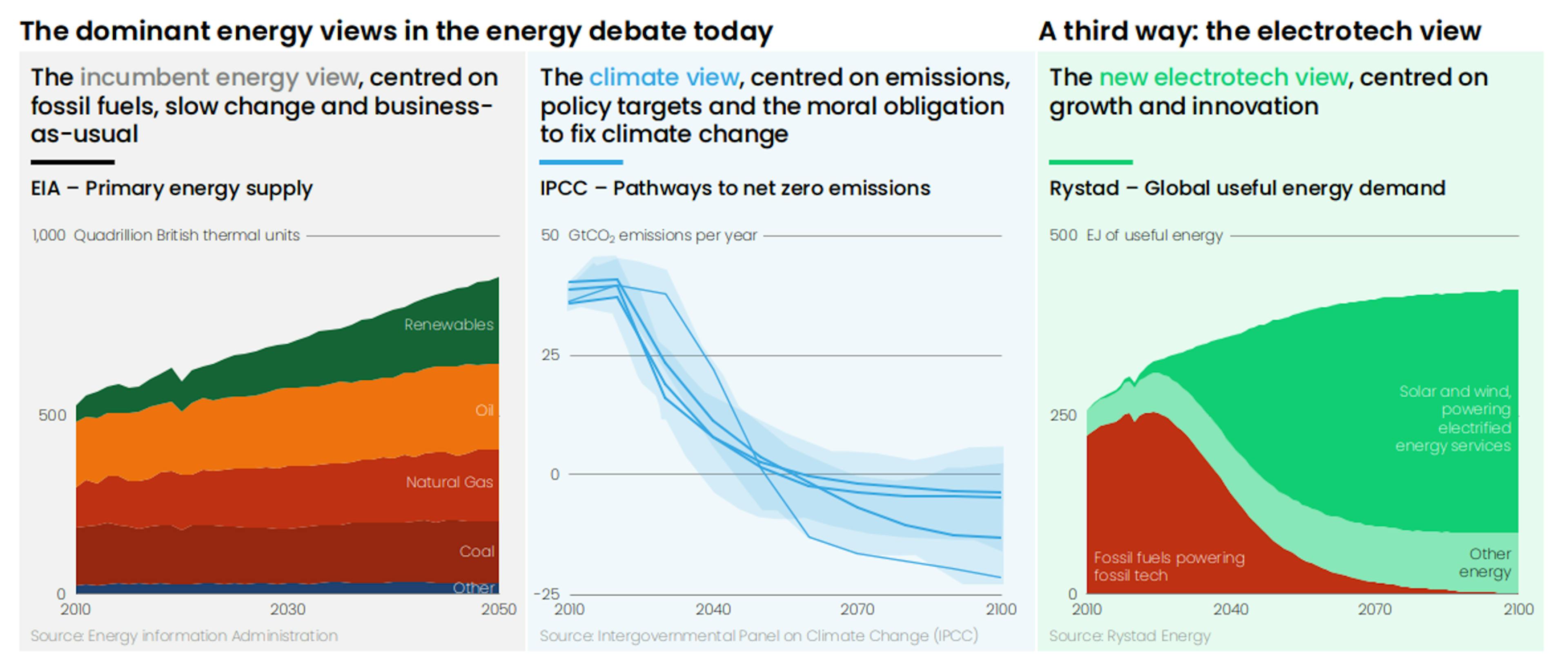

While many global environmental indicators are flashing red, we see several areas of progress with clear investment opportunities. The advancements in the electro-tech sector have fuelled a shift from the exploitation and burning of fossil fuels to farming and storing inexhaustible, cheaper and efficient renewable energy4.

BATTERY STORAGE: A WINDOW OF OPPORTUNITY

Rapid improvements in battery storage economics have allowed solar projects to flourish in recent years. Yearly solar PV5 capacity additions exceeded 500GW globally in 2024 and 2025, representing about 70% of all capacity additions6, making it an increasingly central source of electricity. But this fast growth has led to the “duck curve” phenomenon: solar produces abundant power during daylight hours, then drops sharply in the evening, leaving grid operators to manage steep swings in supply and demand.

Battery storage is emerging as the key solution to this issue due to its ability to smooth out these imbalances by capturing surplus solar power and releasing stored energy during peak demand. The large-scale power outage that struck Madrid in April 2025, which paralysed the city – extending to neighbouring regions as well as Portugal and parts of Southern France – served as a stark reminder of our reliance on the electric grid and the urgent need for back-up solutions.

Rather than pursuing investment opportunities in the battery manufacturing companies who operate in a nearly commoditised market, we see stronger opportunities in engineering, procurement and construction (EPC) companies and players that can leverage existing solar PV capacity within this theme.

WATER: FROM INCREASING EFFICIENCY TO TACKLING SCARCITY

As hyperscalers face rapidly rising electricity demand, improving energy efficiency – especially in cooling – has become a priority. Over the past decade, data centre PUE (Power Usage Effectiveness) has steadily improved, even as computing power and chip heat output (TDP) have surged.

Technology cooling has become more cost and energy efficient, driven by a shift from traditional air cooling to liquid cooling solutions such as direct to chip and immersion cooling. For new AI data centres with rack densities above 50 kW, liquid cooling is now the default. Modern water based cooling uses closed loop systems, meaning water is mostly consumed only during installation, eliminating long term water stress concerns.

The heat rejection system remains central to water efficiency, with options ranging from water intensive evaporative cooling to power intensive dry cooling. Hyperscalers are increasingly making water conscious decisions, reflected in commitments like Microsoft’s new data centre standards7 and Amazon’s pledge to be water positive by 20308.

Because hyperscalers are already improving water efficiency, we expect the investment focus within the water theme to shift elsewhere in 2026. Beyond new irrigation technologies and drought tolerant crops, the desalination industry is particularly attractive, supported by falling costs, large scale Middle Eastern projects, and maturing reverse osmosis technology. Desalination’s share of global drinking water has risen from 1% in 2017 to 4% in 20249, and the market (worth circa $20bn) is expected to grow at a high single digit rate over the next decade10.

Social outlook

RAI TO COME INTO FOCUS

As AI advancements accelerate, regulators have been slow to provide consistent guidance around transparency, accountability, bias, intellectual property, and data use, while the EU rolls back its landmark AI regulation11. The gap between Responsible AI (RAI) best practices and deployment at scale keeps widening. This tension became visible during the OpenAI governance crisis, which prompted the organisation to shift its structure toward a more RAI aligned public benefit corporation model. We expect these governance pressures to continue.

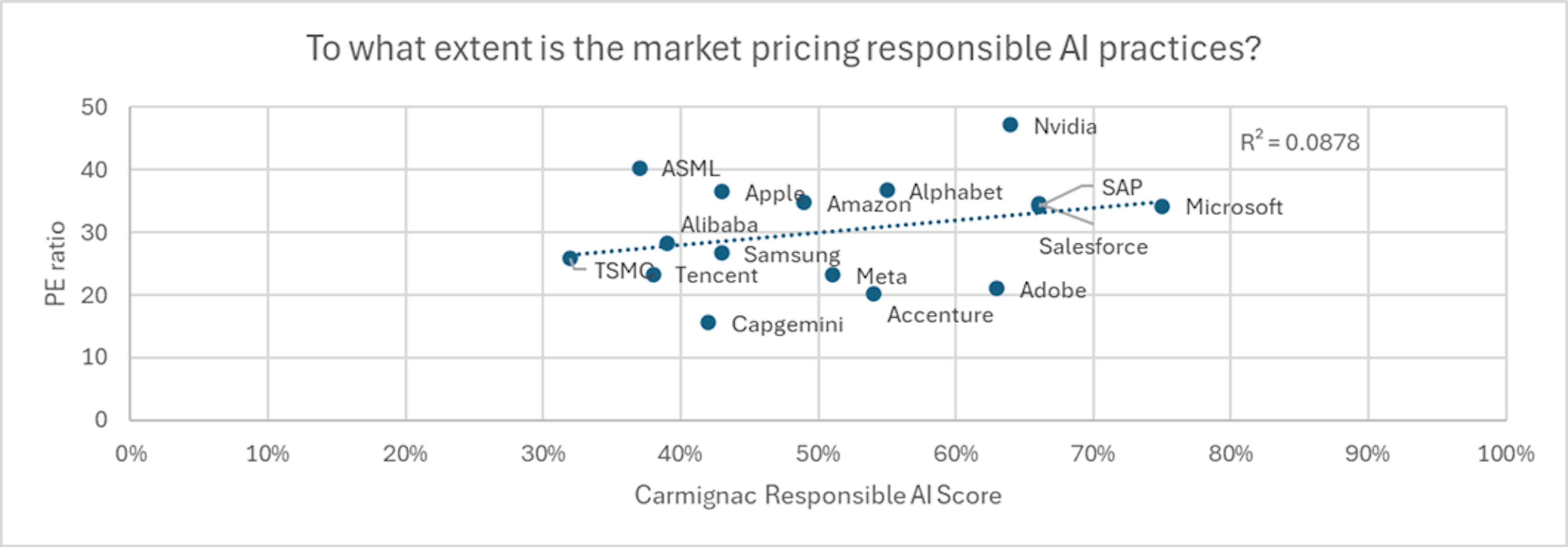

So far, markets have largely ignored RAI performance, treating it more as reputational management than a price driver. Carmignac’s RAI score shows only a weak link to valuation, explaining just 8.8% of the variation in AI sector PE ratios. However, this could change very quickly, making strong AI governance a key area to monitor.

CONTINUOUS WEAKENING OF SUPPLY CHAIN STANDARDS

In 2025, numerous EU and national supply-chain and human rights regulations were weakened or targeted for repeal, reducing reporting obligations and lowering corporate accountability. With cost pressures intensifying, suppliers may face declining labour and safety standards in 2026, especially in high risk sectors. A looser regulatory environment raises the chance of exposé-style NGO investigations gaining media attention, increasing reputational risks for companies. As a result, it will be essential to scrutinise supply chain disclosures more closely and proactively engage with firms to detect any decline in standards.

RECONCILING DEFENCE WITH SUSTAINABILITY

In 2025, several European asset managers loosened their defence exclusions policies, enabling Article 8 funds to invest in conventional weapons, subject to bespoke due diligence and engagement. As a result, the share of Article 8 funds with exposure to aerospace and defence increased from 48% in 2024 to 56% in 202512. In 2026, we expect continued debate over reframing defence investments as contributing to “sustainable resilience.”

Governance outlook

DEEPER STATE INVOLVEMENT IN THE US

In 2026, government intervention is becoming more prevalent in corporate governance, especially in the US. What began as a backlash against stakeholder capitalism and DEI has evolved into broader regulatory moves that weaken shareholder influence, such as defaulting retail votes to management and limiting shareholder resolutions or litigation. However, this does not expand managerial autonomy; instead, we are witnessing more direct state involvement in corporate decisions driven by national security and economic nationalism considerations.

DEREGULATION TO DRIVE COMPETITIVENESS IN EUROPE

In Europe, government intervention on national security grounds increased in 2025, exemplified by the Dutch government’s decision to invoke emergency powers to take effective control of a domestic chipmaker and curtail the influence of its Chinese parent company. While more state action is likely in 2026, the bigger shift is a growing push for deregulation and simplified governance to boost the region’s competitiveness. Concerned about rising delisting and equity market weakness, policymakers are increasingly reconsidering governance rules, and a more flexible approach is expected to gain momentum in the absence of investor resistance.

ASIA TO CONTINUE TESTING GOVERNANCE REFORM

Inspired by Japan’s success and supported by the growth of retail investors, who in turn are voters, South Korea’s government is focusing on increasing shareholder value through a series of legal and exchange-driven reforms. For example, the landmark introduction of a fiduciary duty for board directors to shareholders. While the early stages of reform were sufficient to trigger significant investor enthusiasm, illustrated by the 2025 highs in the KOSPI index, 2026 will be the real test of the robustness of these initiatives, including execution. In Japan, stakeholder considerations are likely to come to the fore with the newly elected Prime Minister calling for higher wages and wage driven inflation, pushing companies to increase pay as part of national economic policy.

The full version of Carmignac’s 2026 Sustainable Investment Outlook is available to view here.

1Sources: Carmignac Data, 2025.

2Alpha is a measure of an investment's performance that indicates its ability to generate returns in excess of its benchmark.

3Beta is a measurement of the price volatility of a stock or other asset relative to the market as a whole.

4Ember (2025); The Electrotech revolution.

5PV: photovoltaic.

6Renewables 2025 | IEA.

7Sustainable by design: Next-generation datacenters consume zero water for cooling | Microsoft.

8Water stewardship - Amazon Sustainability.

9IDRA – Desalination & Reuse Handbook 2025-2026.

10Global Water Desalination Market YoY Growth Rate, 2025-2032, Coherent Market Insights.

11https://theconversation.com/eu-proposal-to-delay-parts-of-its-ai-act-signal-a-policy-shift-that-prioritises-big-tech-over-fairness-268814.

12Morningstar data 2025.

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com/en, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.com/en-gb, or upon request to the Management Company, or for the French Funds, at the offices of the acilities Agent, Carmignac UK Ltd, 2 Carlton House Terrace, London, SW1Y 5AF. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.com/en-ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.

For Carmignac Portfolio Long-Short European Equities: Carmignac Gestion Luxembourg SA in its capacity as the Management Company for Carmignac Portfolio, has delegated the investment management of this Sub-Fund to White Creek Capital LLP (Registered in England and Wales with number OCC447169) from 2nd May 2024. White Creek Capital LLP is authorised and regulated by the Financial Conduct Authority with FRN : 998349.

Carmignac Private Evergreen refers to the Private Evergreen sub-fund of the SICAV Carmignac S.A. SICAV – PART II UCI, registered with the Luxembourg RCS under number B285278.